Corporate Action - Split/Merger

Introduction

In this section, we will explain how the corporate actions can be managed on DECAF's cafelatte user interface.

Split/Merger

Whenever a stock split/merger occurs, quantities and cost | market prices change by a certain factor as a result of the split/merger.

In DECAF, the implication is that from the day of such corporate action onwards, the stock's quantities and cost price will not reflect the actual stock condition in the market if left untreated.

However, it is a fairly easy and straight-forward process. Essentially, following actions need to be taken:

- Close the existing position with trade date of the corporate action day for a price of the prevailing close of the same day, and

- Open a new position with trade date of the corporate action day, whereby quantities and cost prices reflect the new conditions for the stock.

Here is an example how such corporate action.

Example: Google Stock Split

Note: The procedure for Stock Splits and Mergers are exactly the same. Only the values to be entered are changing.

Let's assume Google's stock was split by 2 on January 24, 2020. On the same day, the stock price went from 2,932, while the effective quantities in the portfolios are divided by 2.

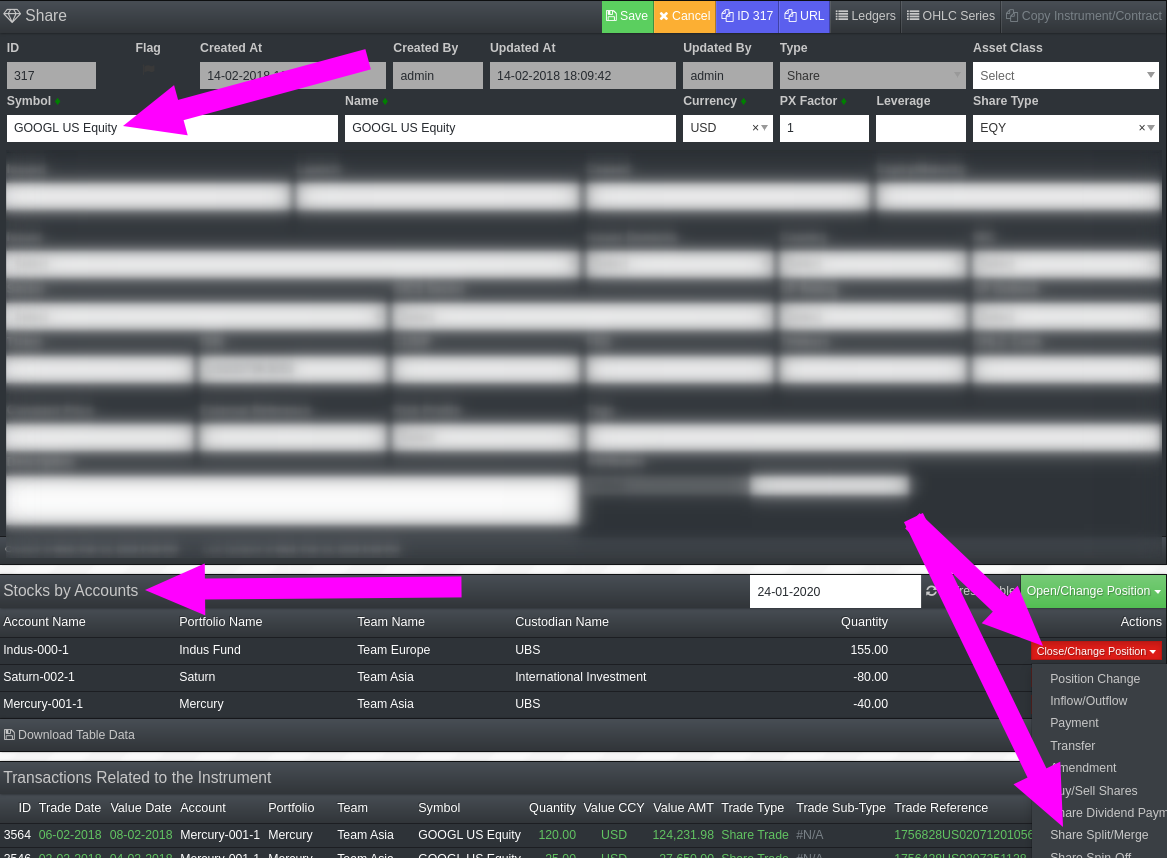

When we go onto the instrument details page for Google, we will see the section Stocks By Accounts. In the screenshot below, we can see that 3 accounts are holding the instrument.

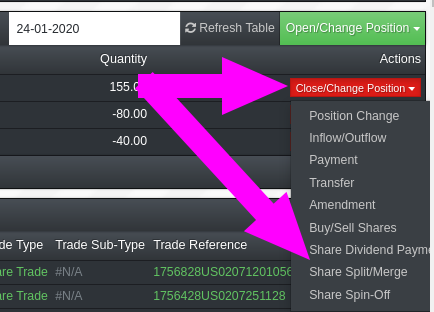

For each holding, you will also see an Actions dropdown. After clicking the Actions dropdown, a list with available actions will appear. Please refer to the below 2 screenshots.

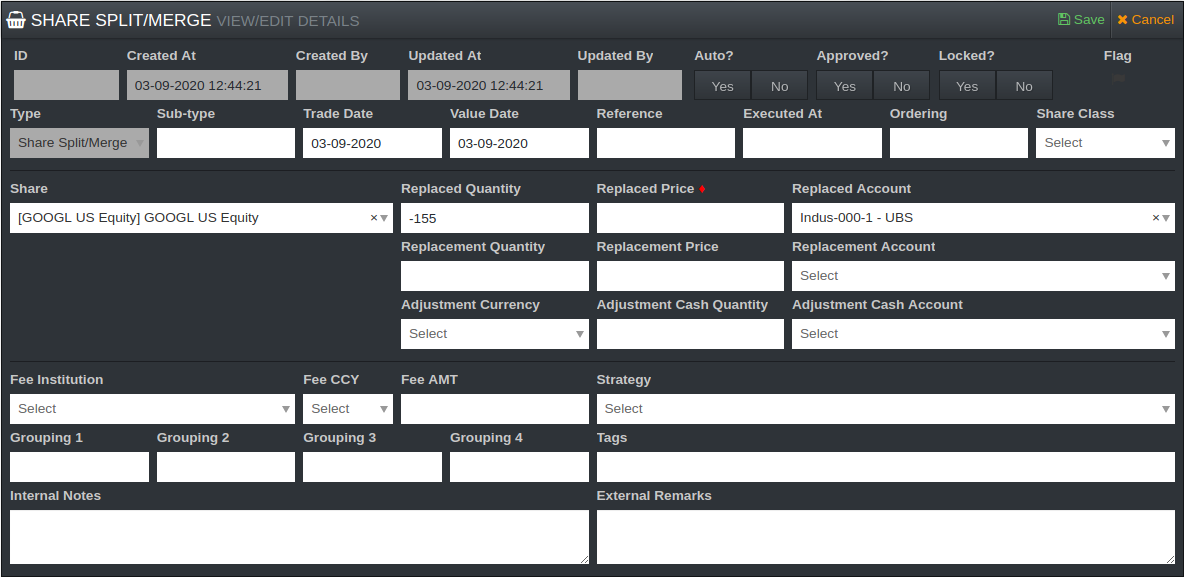

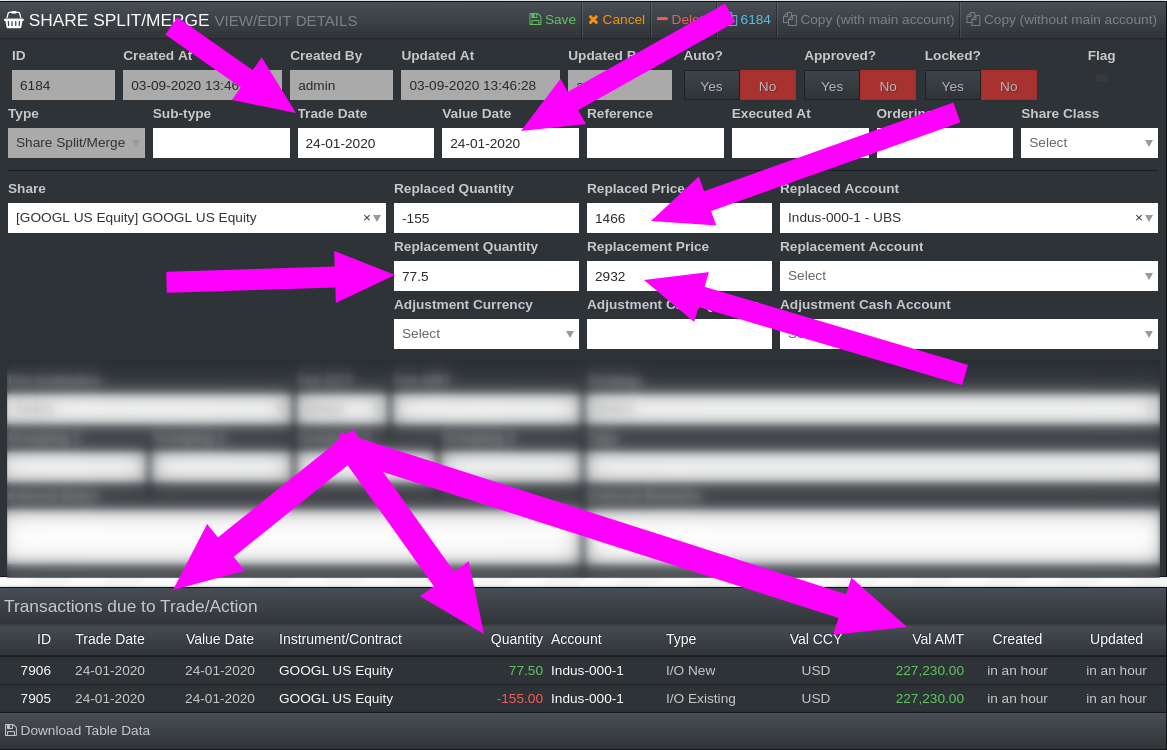

Once Share Split/Merger is selected, the system will bring you to the positions actions page. On the resulting page, you will see a few fields prepopulated. These prepopulated fields refer mostly to the first step of the actions mention above, i.e the closing of the existing position. You will have to enter following values:

- [Trade Date] Change the date to 24th of January

- [Replaced Price] Enter the closing price of the old position (in most cases this is the last closing price of the old position). In this example, we will enter $1,466.

- [Replacement Quantity] Enter the new quantity after the split. In our case, we will divide the old quantity (155) by 2.

*Note: If you have an automated datafeed | position reconciler, the changes in the quantites will most likely be already reflected. In such case, if the quantities have been adjusted correctly, you may use the suggested inverse of the Replacement Quantity* without any division/multiplication.

- [Replacement Price] Enter the new price at which the position should start (in most cases it is the opening price after the split). In our case, we will use $2,932.

Once you entered those values and save the page, you will see the actions the system has taken at the table below Transactions Due to Trade/Action.