Setting up a Fund

In essence, a Fund is a portfolio with a Share Class attached to it. In this guide, we will setup a fully fledged fund with two share classes, their share class fee schedules and other accrual schedules. Then we will record subscriptions to the fund and trigger daily calculations to see the NAV/share and accrual amounts.

Storyline

Our fund is called Terra Funds Limited which is incorporated in Singapore on July 1st, 2018. The fund trades various asset classes but mainly shares. There are two custodians of the fund, namely Bank of Orien and Woodgrove Bank.

Overall Definitions

The overall particulars of the fund are:

| Definition | Value |

|---|---|

| Name of the fund | Terra Funds Limited |

| Short name of the fund | Terra |

| DECAF Team which the fund belongs to | Team Funds |

| Reference currency of the fund | USD |

| Domicile of the fund | Singapore |

| Benchmark of the fund | #N/A |

| Investment manager of the fund | Clarke Kent |

| Objective/Strategy of the fund | Growth |

| Risk profileof the fund | Growth |

| Source of the data for the fund | Manual |

Share Class Structure

In terms of share class structure, the fund has two share classes with following particulars:

| Definition | First Share Class | Second Share Class |

|---|---|---|

| Name | Terra Share Class A | Terra Share Class B |

| Currency | USD | EUR |

| Management Fee Payment Frequency | Yearly | Yearly |

| Performance Fee Payment Frequency | Yearly | Yearly |

| Minimum Investment | USD 100,000.00 | EUR 100,000.00 |

| ISIN | ZZ111111111 | ZZ222222222 |

| BBG Ticker | #N/A | #N/A |

| Liquidity | #N/A | #N/A |

| Jurisdiction | Singapore | Singapore |

| Administrator | Great Fund Administrators Ltd. | Great Fund Administrators Ltd. |

| Subscription/Redemption Period | End of Month | End of Month |

| Management Fees | 0.50% with daily accruals based on Act/Act day count convention. | 0.50% with daily accruals based on Act/Act day count convention. |

| Performance Fees | #N/A | #N/A |

Accrual Schedules

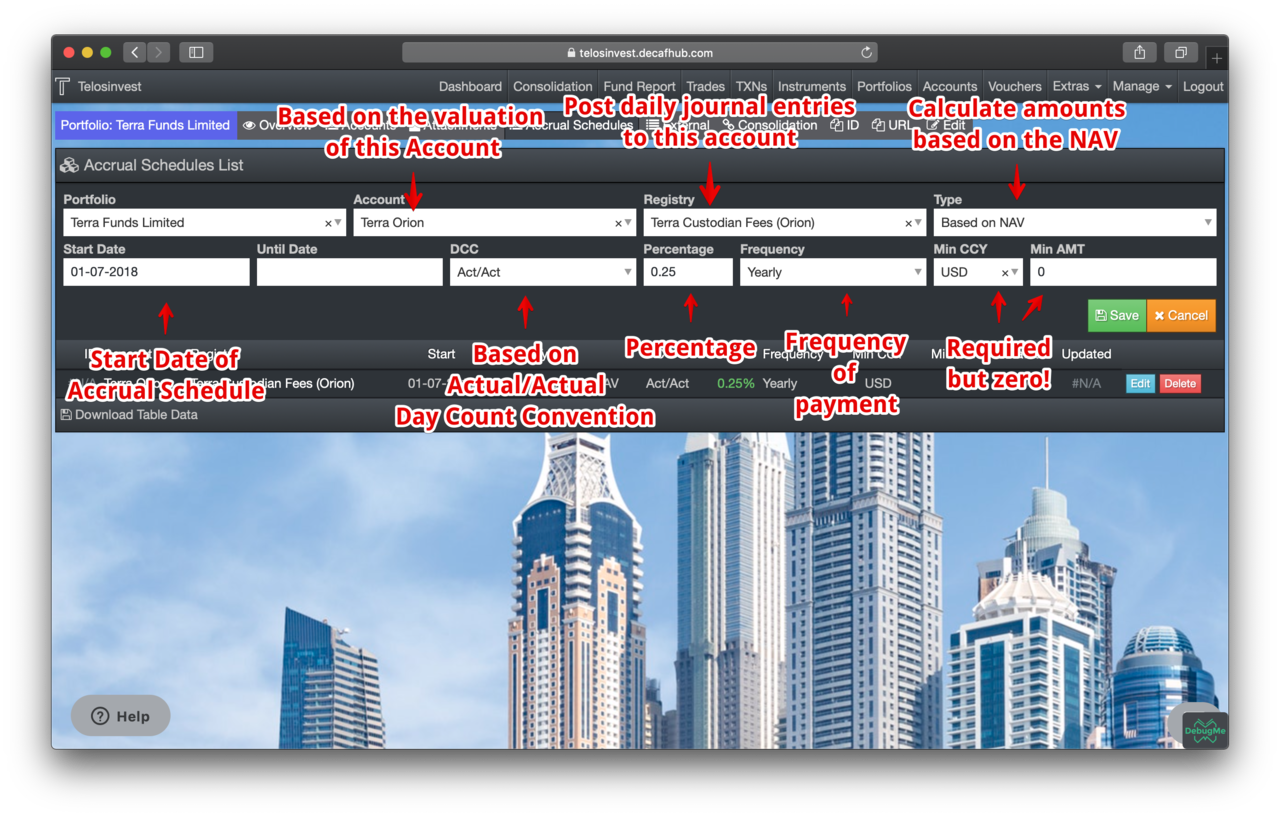

In terms of accrual schedules, we have three definitions:

| Definition | Custodian Fees (for Bank of Orion) | Custodian Fees (for Woodgrove Bank) | Administrator Fees |

|---|---|---|---|

| Account of the base valuation | Terra Orion | Terra Woodgrove | #N/A (ie. entire valuation) |

| Account to post daily accruals to | Terra Custodian Fees (Orion) | Terra Custodian Fees (Woodgrove) | Terra Admin Fees |

| Type of accrual | Based on NAV | Based on NAV | Based on NAV |

| Start Date | Inception (ie. July 1st, 2018) | Inception (ie. July 1st, 2018) | Inception (ie. July 1st, 2018) |

| Until Date | #N/A | #N/A | #N/A |

| Day Count Convention | Act/Act | Act/Act | Act/Act |

| Percentage | 0.25% | 0.15% | 0.20% |

| Frequency | Yearly | Yearly | Yearly |

| Minimum Amount | USD 0.00 (ie. no minimum) | USD 0.00 (ie. no minimum) | USD 20,000.00 |

Setting up Portfolio of the Fund

- Go to Portfolios.

- Click "New" on the right upper corner.

- Fill in details as per storyline and as shown on below screenshot.

- Save.

Before the save operation, your portfolio creation form should look like below screenshot:

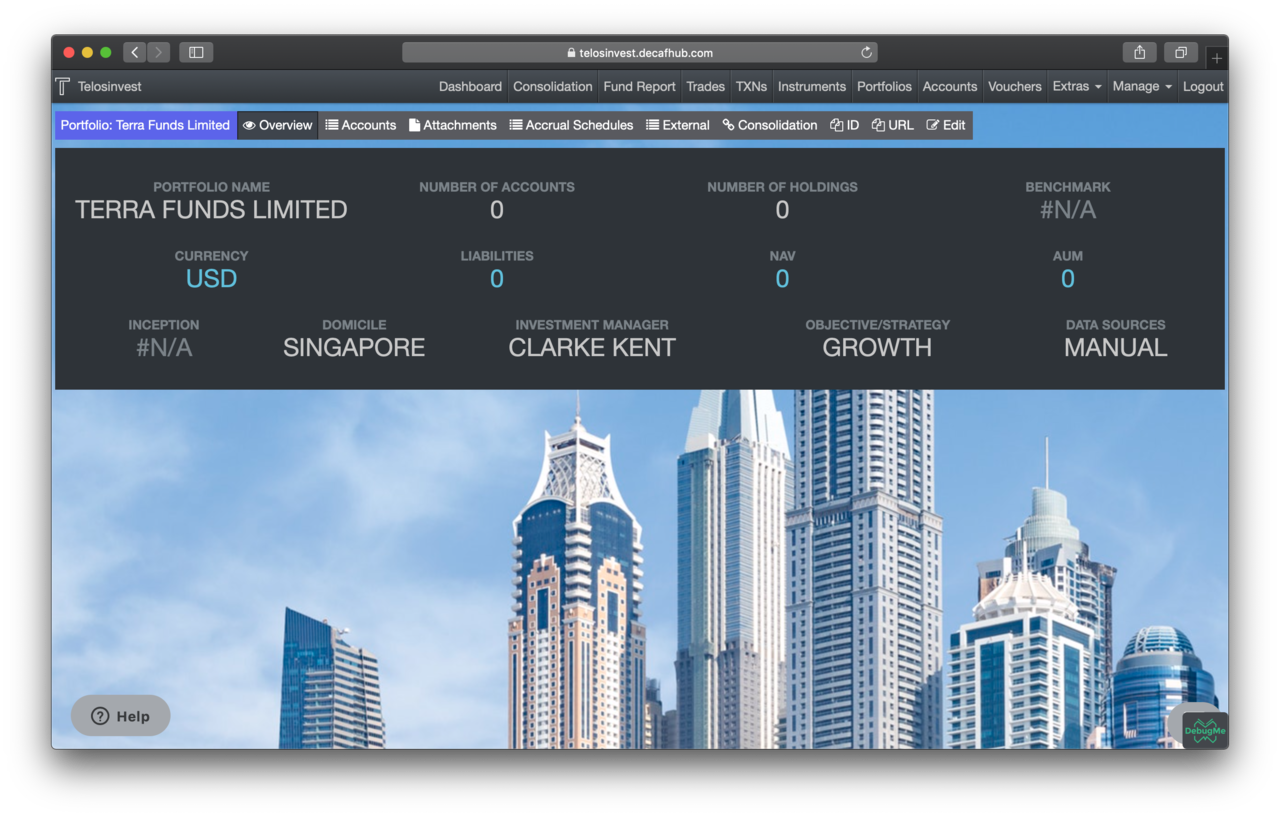

After the save operation, you will be redirected to the portfolio details page.

Note that each fund is essentially a portfolio with one or more share classes attached to it. By now we don't have any shareclasses, therefore we can not yet call our portfolio a fund yet.

Setting up Custody Accounts

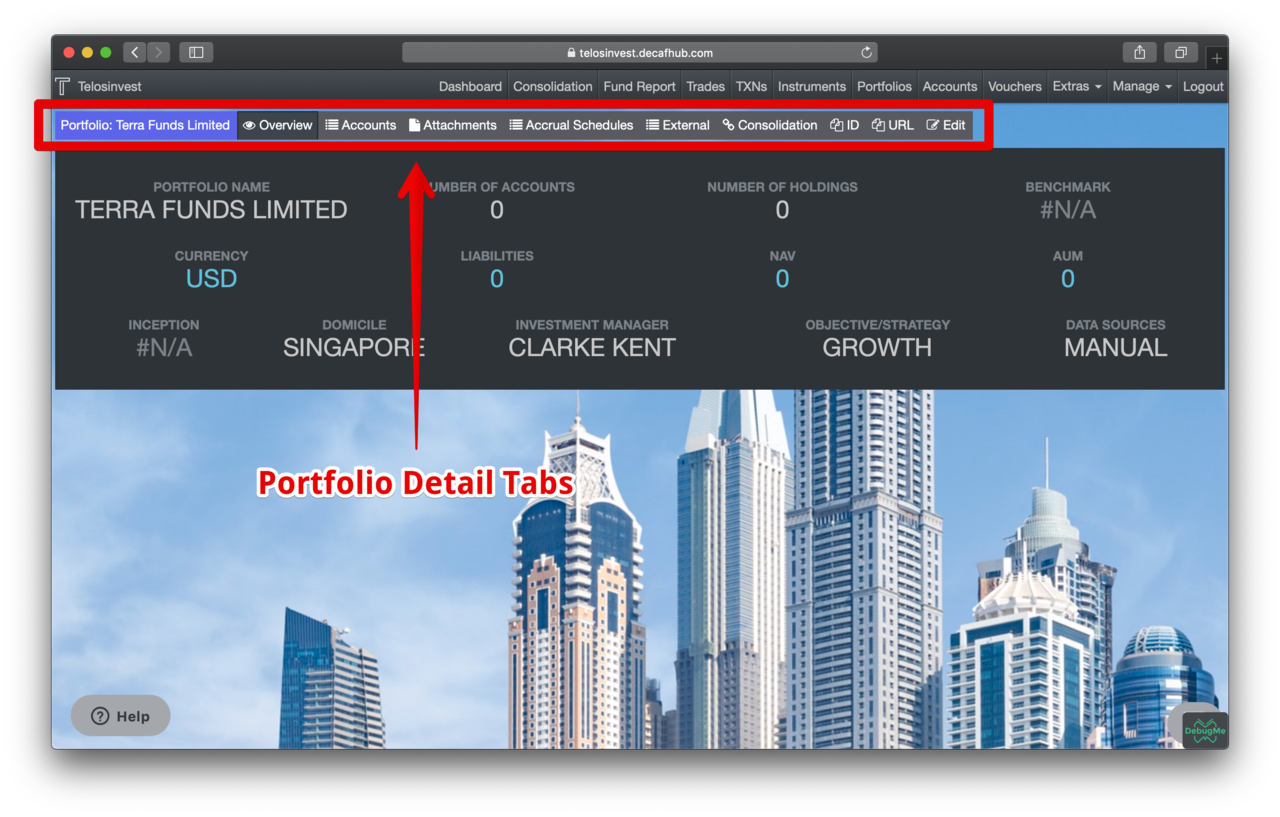

As per the storyline, we have two custodians. We will create one for each account. On the portfolio details page, we see some tabs:

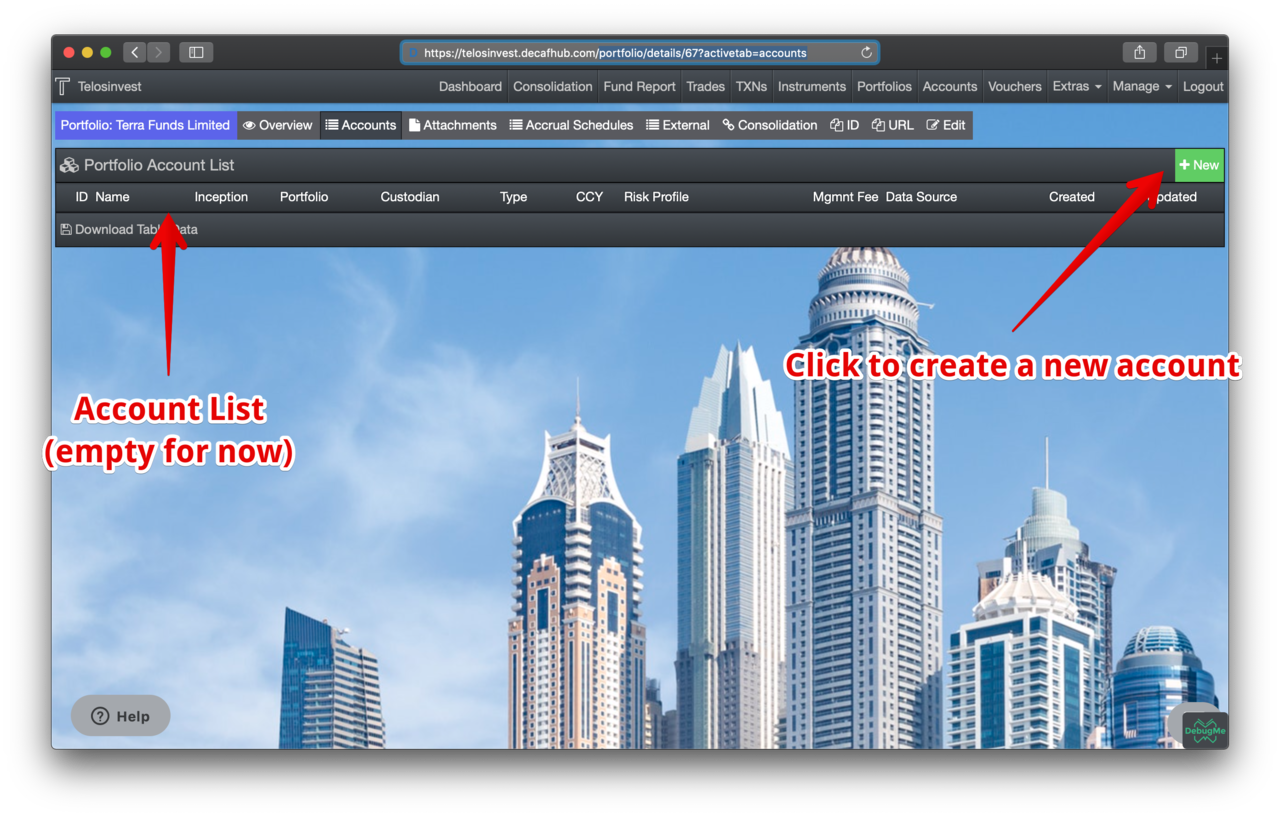

One of these tabs is the "Accounts tab". This tab shows you the list of all accounts and allows you to create new accounts if you need one:

Let's click on the "New" button and create our first custody account at "Bank of Orion". The form should look like below before you save:

After you save, you will see your account on the list:

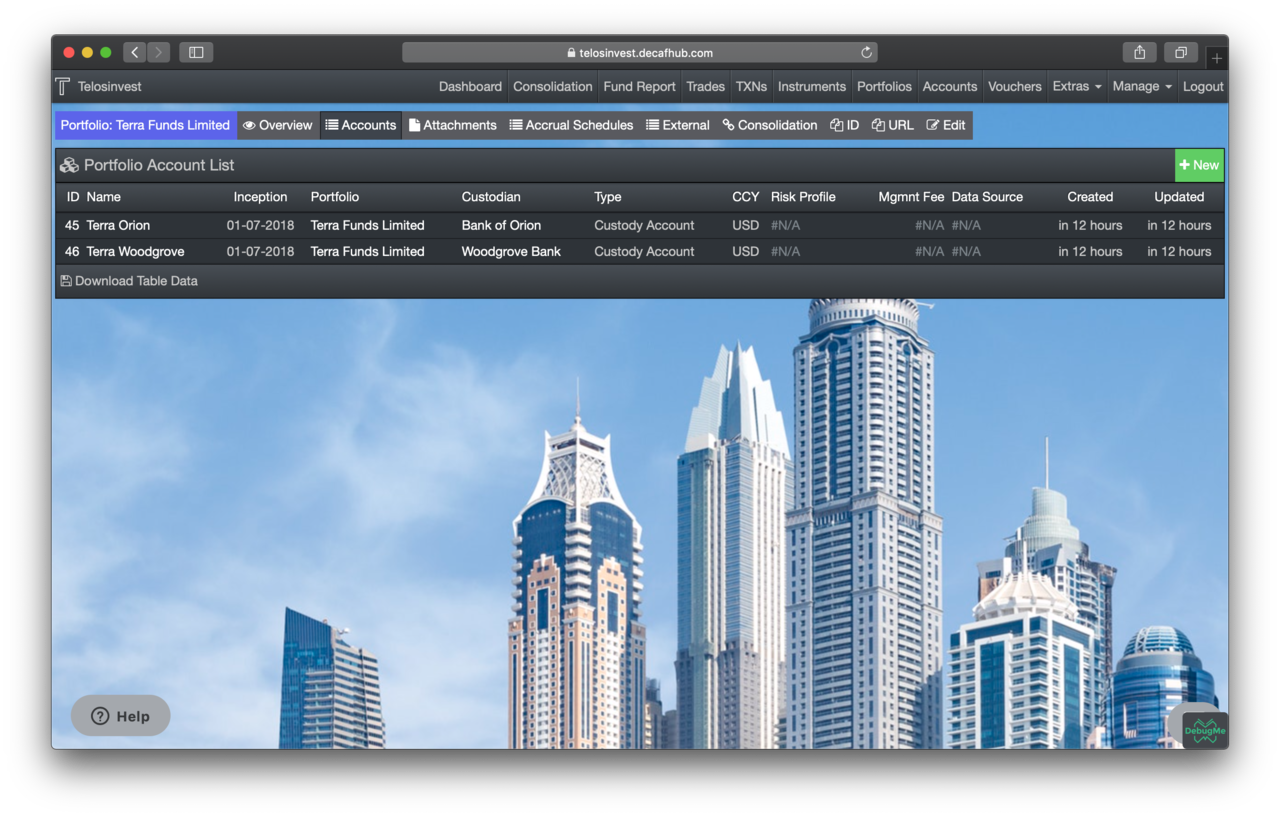

Similarly, after creating the account custodied at Woodgrove Bank, our account list should look like this:

Setting up Analytical Accounts

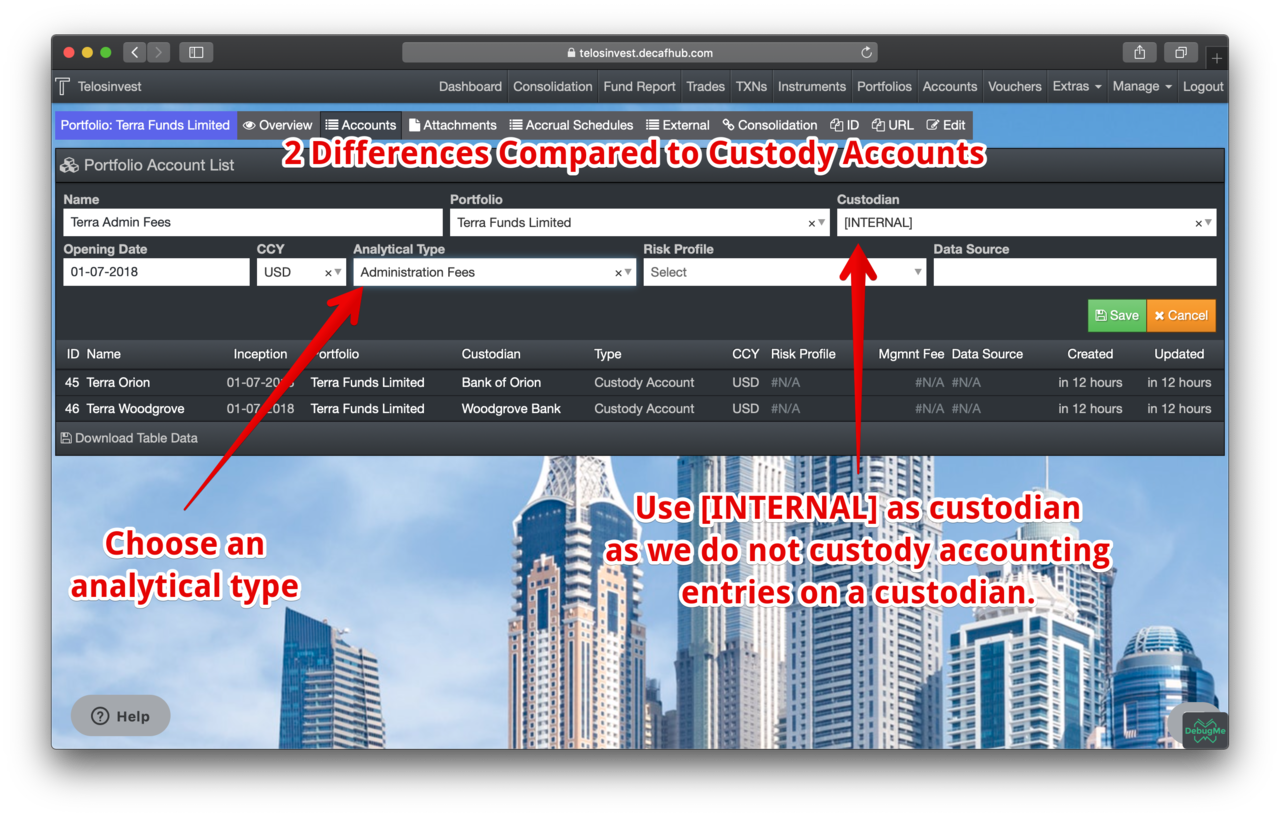

Analytical accounts are accounts which are used to hold partial and journal entries which are required for fund management and administration purposes. The difference between an analytical account and custody account are very slim: Analytical accounts have an extra field called "Analytical Type". Before we create our analytical accounts for Terra, first we need to create "Analytical Types" of our interest.

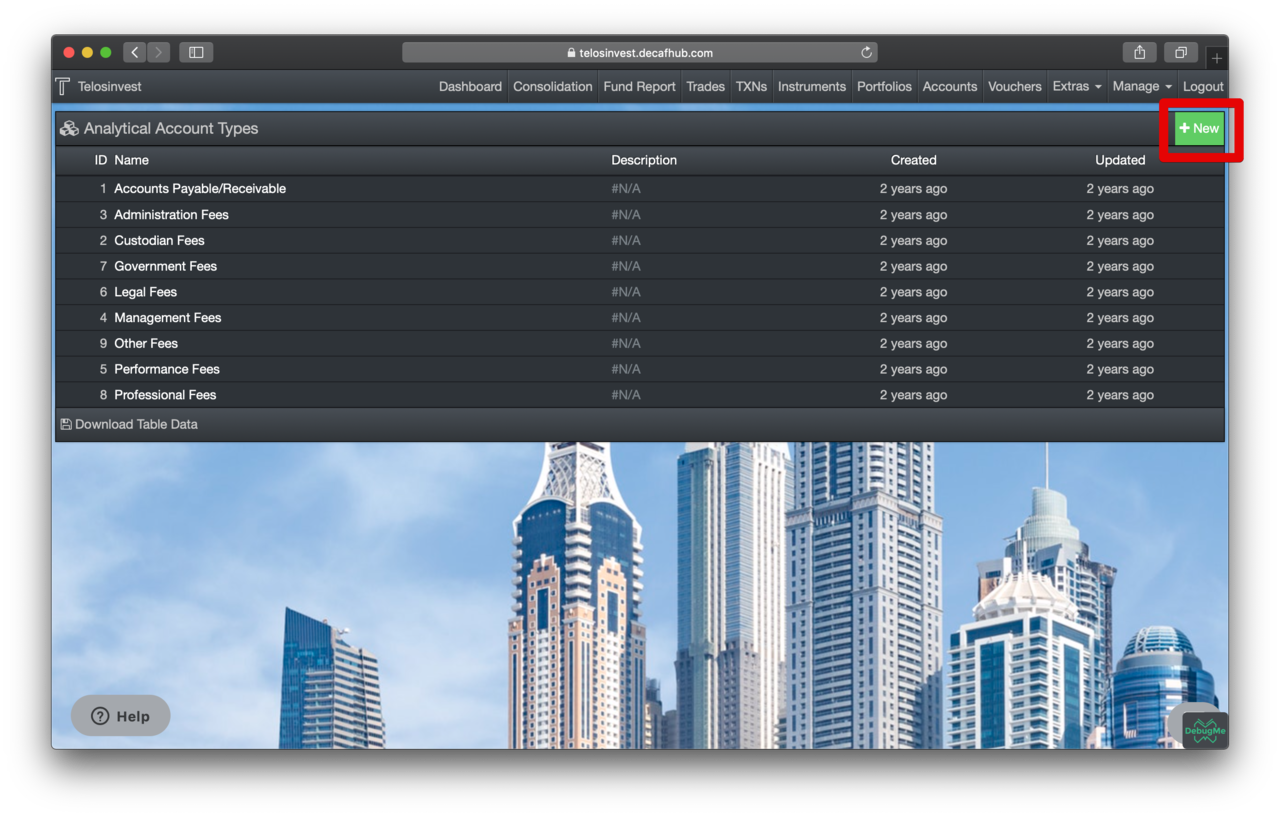

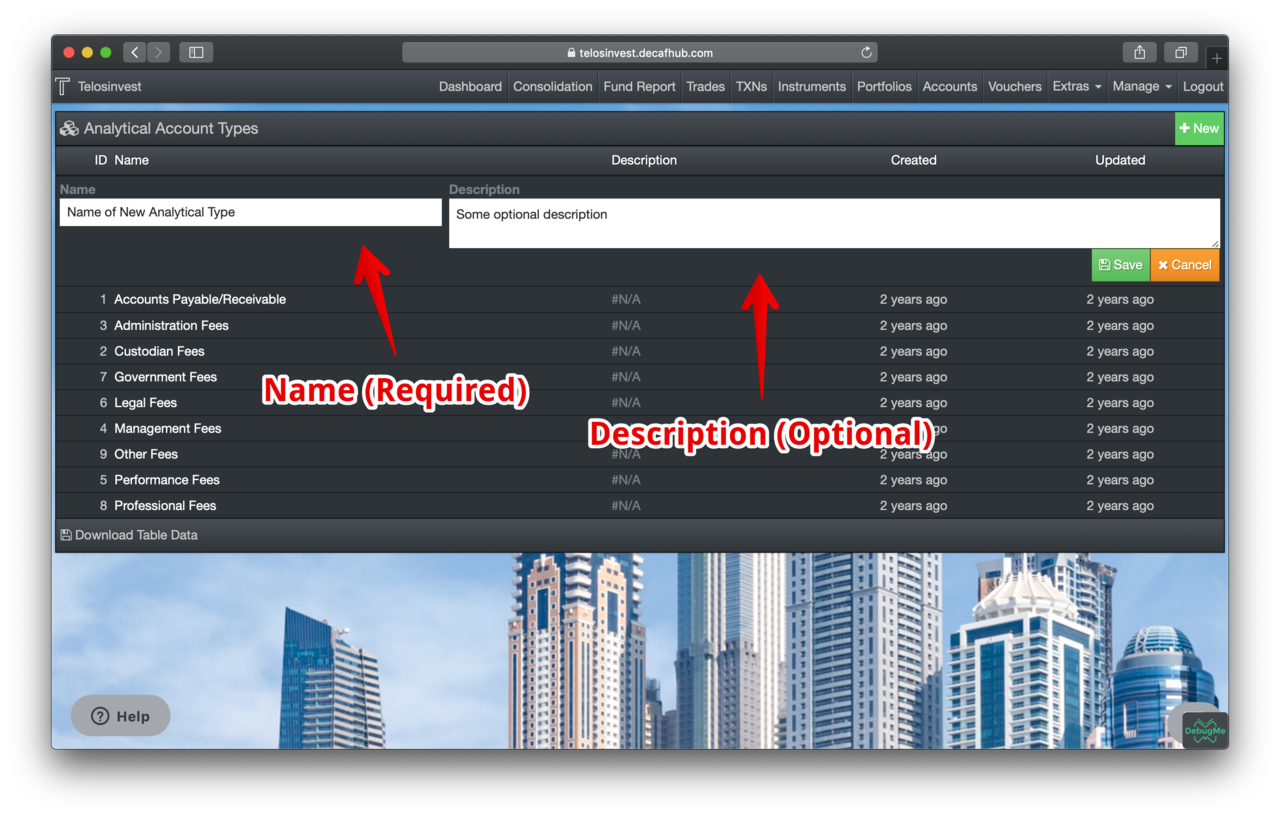

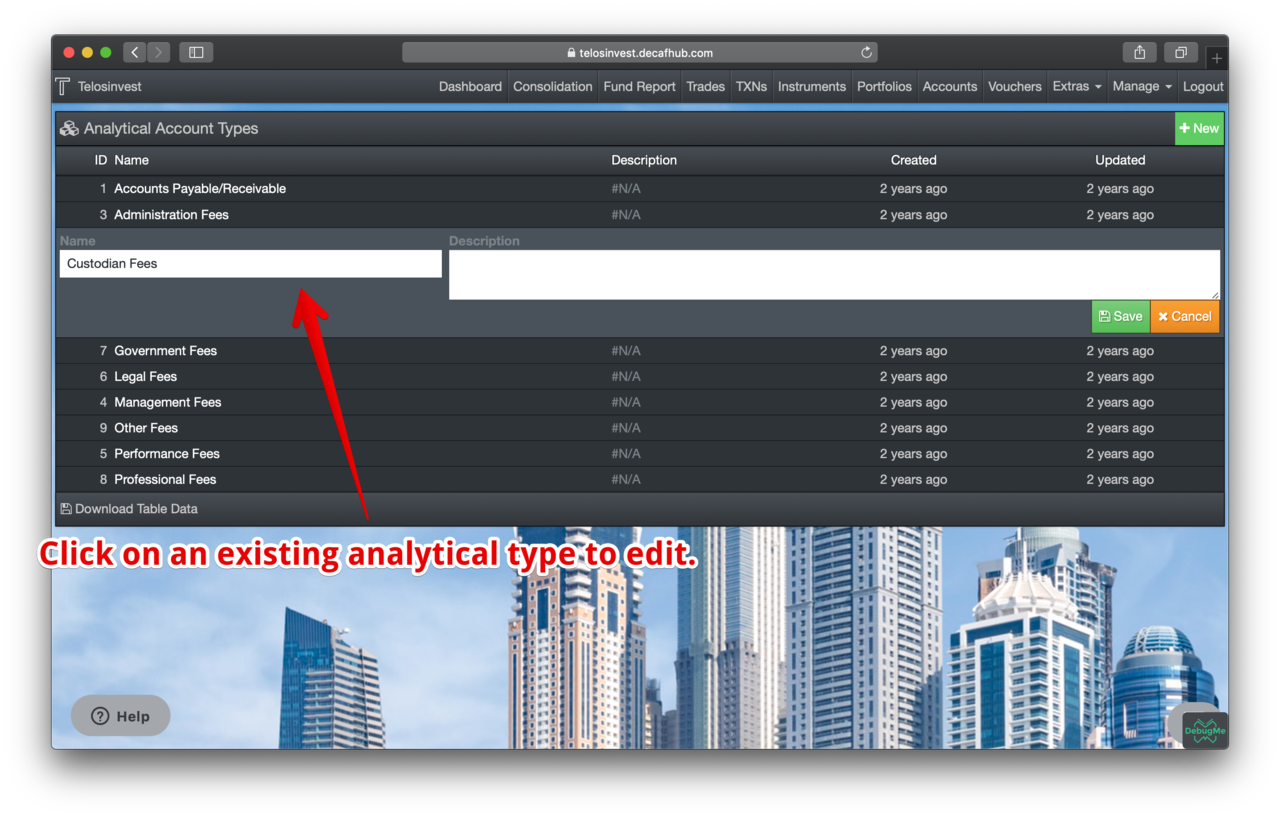

Creating Analytical Types

Analytical types are analogous to Chart of Accounts in the accounting sense. They help us to organise our journal entries such as accruals and render accounting reports.

We need a few analytical types for our fund:

- Custody Fees

- Administrator Fees

- Management Fees

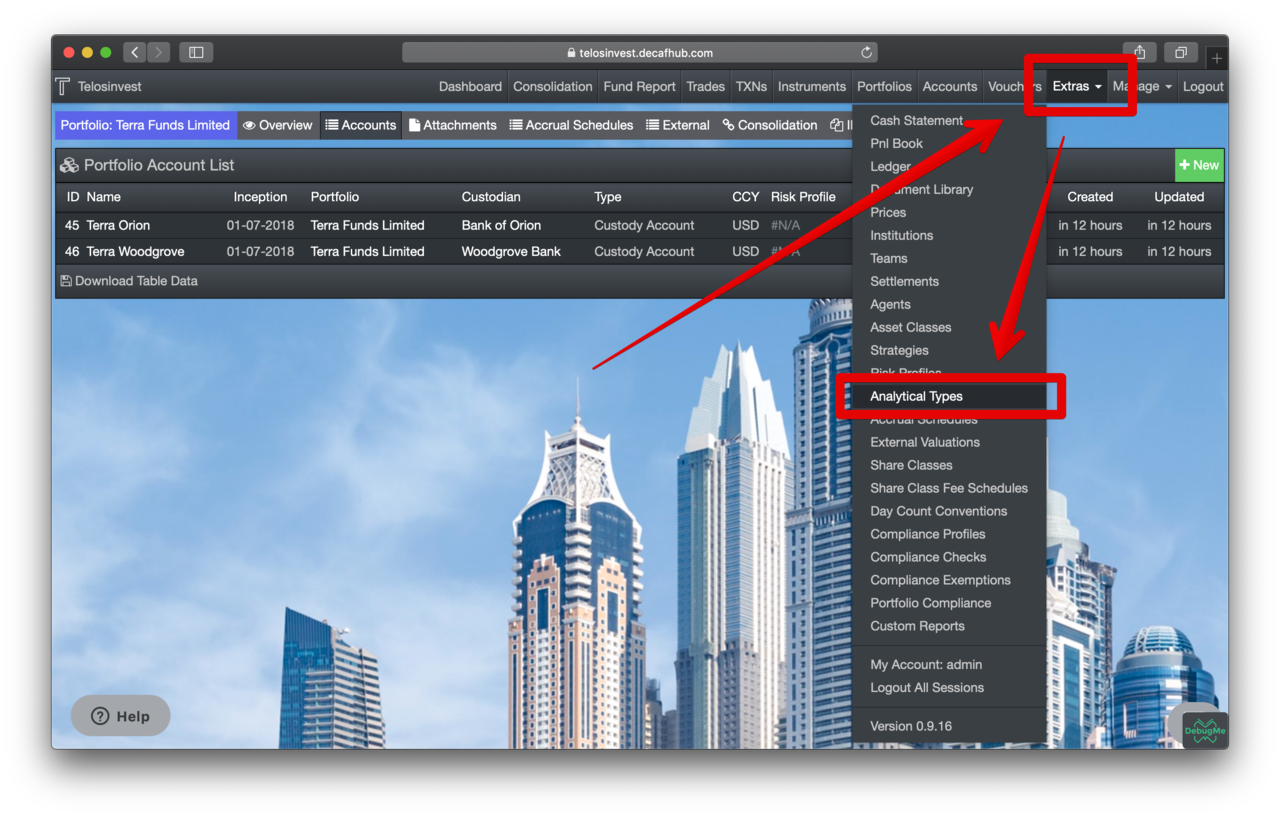

Let's go to "Analytical Accounts" registry by following the menu items

Extras > Analytical Types:

Create Analytical Accounts

We can now create analytical accounts almost the same way as we created custody accounts. Let's see the example entry form for administration fees:

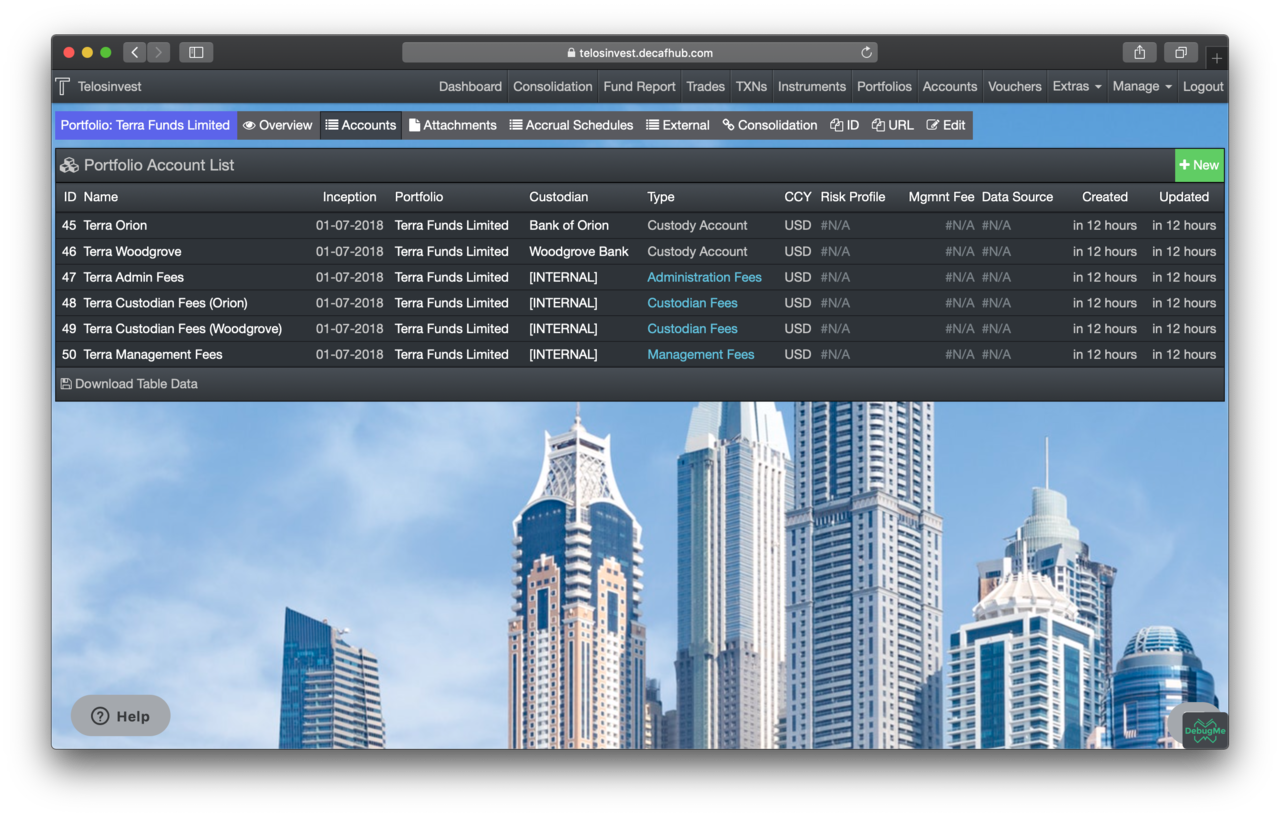

After we create all analytical accounts, the list should look like below. Note that we have created an analytical account for "Management Fees", too.

Setting up Generic Accrual Schedules

Accrual schedules are telling DECAF how to capture daily accruals and reflect them on the related analytical accounts on a daily basis. There are two kinds of accrual schedules:

- Share Class Related Accrual Schedules: These include management fees and performance fees. In our example, we have only management fees.

- Generic Accrual Schedules: These can be arbitrarily created for any kind of accrual schedules such as administration fees, custodian fees, fixed value linear deprecation (such as for setup fees) etc.

They are more or less similar. But it depends where we create them. As for the Share Class Related Accrual Schedules, we need share classes. But we don't have any share classes yet. This means, our fund is still a plain vanilla portfolio. Here, we are going to first create our 3 generic accrual schedules:

- Custodian fees schedule for Bank of Orion

- Custodian fees schedule for Woodgrove Bank

- Administration fees schedule

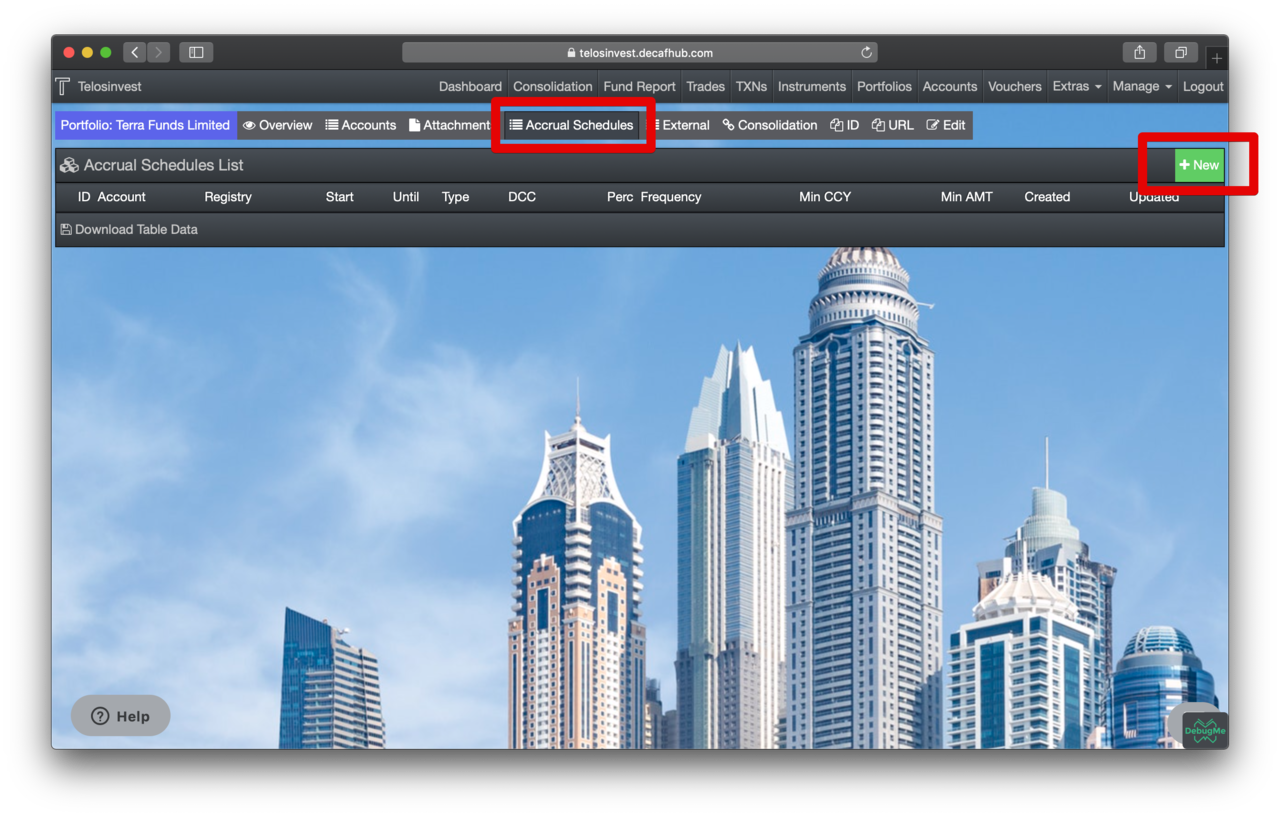

Let' go to "Accrual Schedules Tab" on our "portfolio details page".

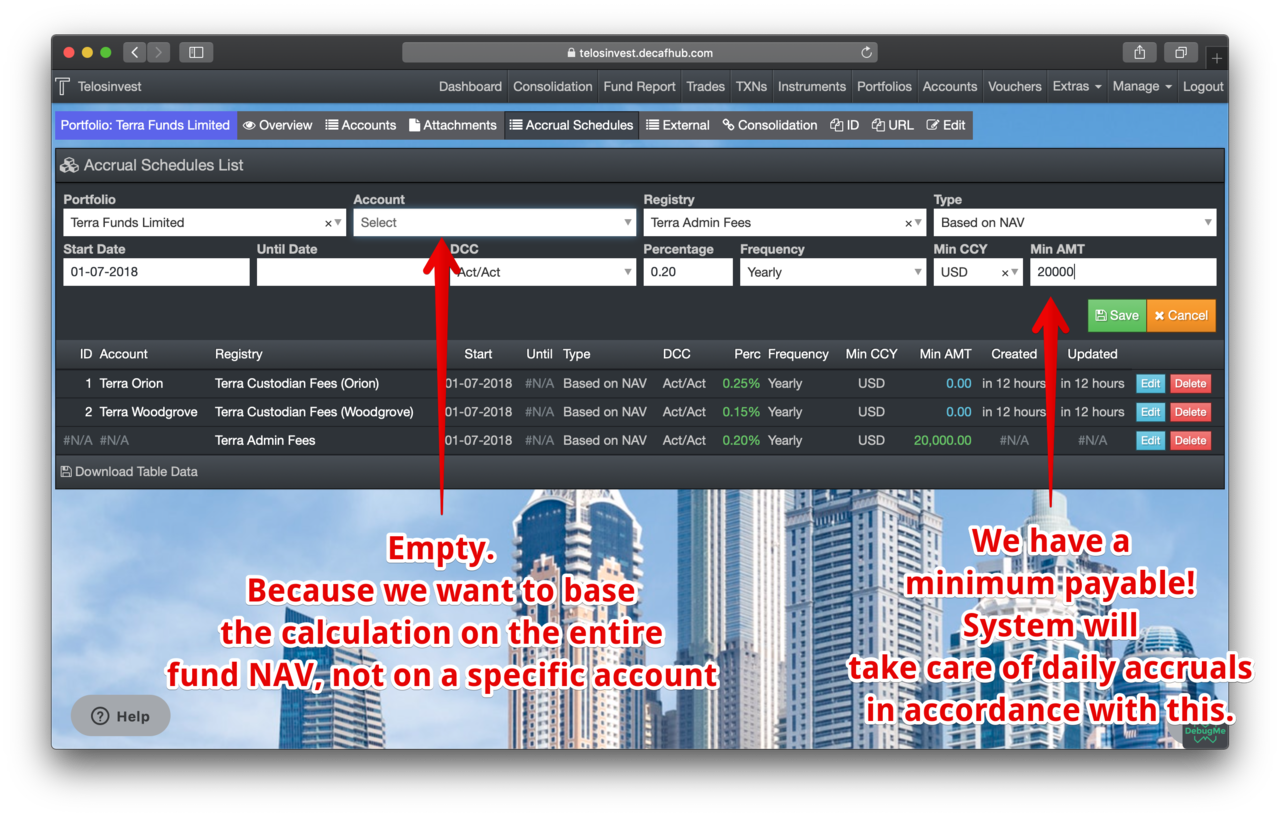

We will create the three accrual schedules. The custodian fees are similar, therefore below screenshots show only of Bank of Orion. But note the differences in administration fees schedules.

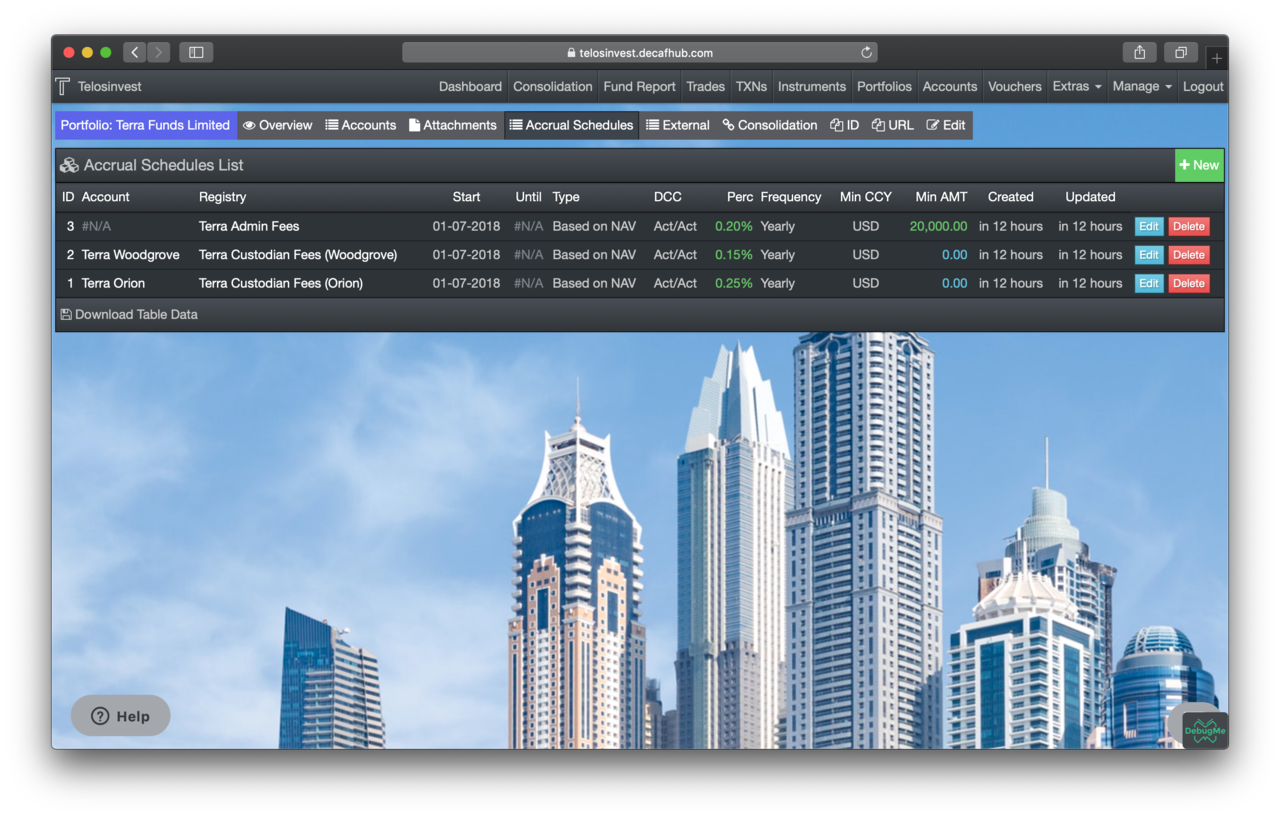

Our final accrual schedules list shows as follows:

Setting up Share Classes

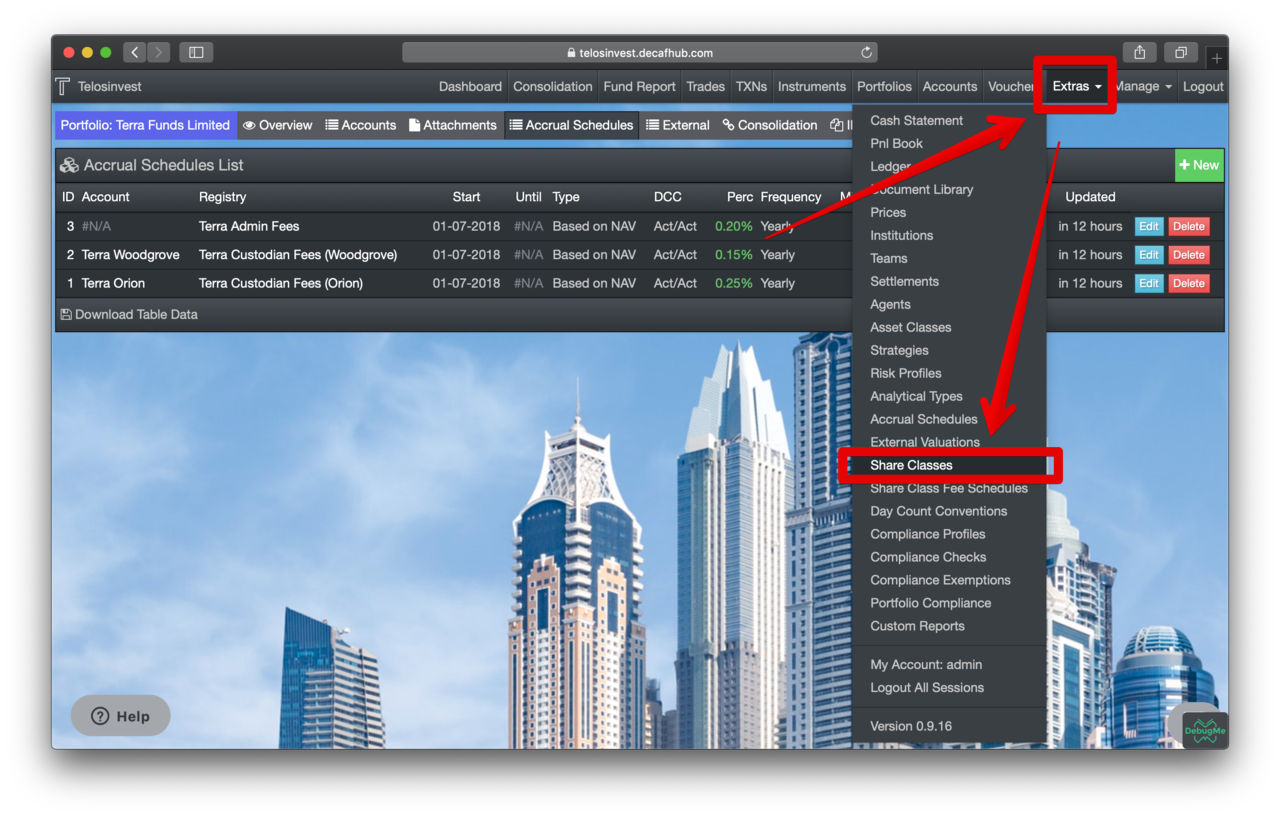

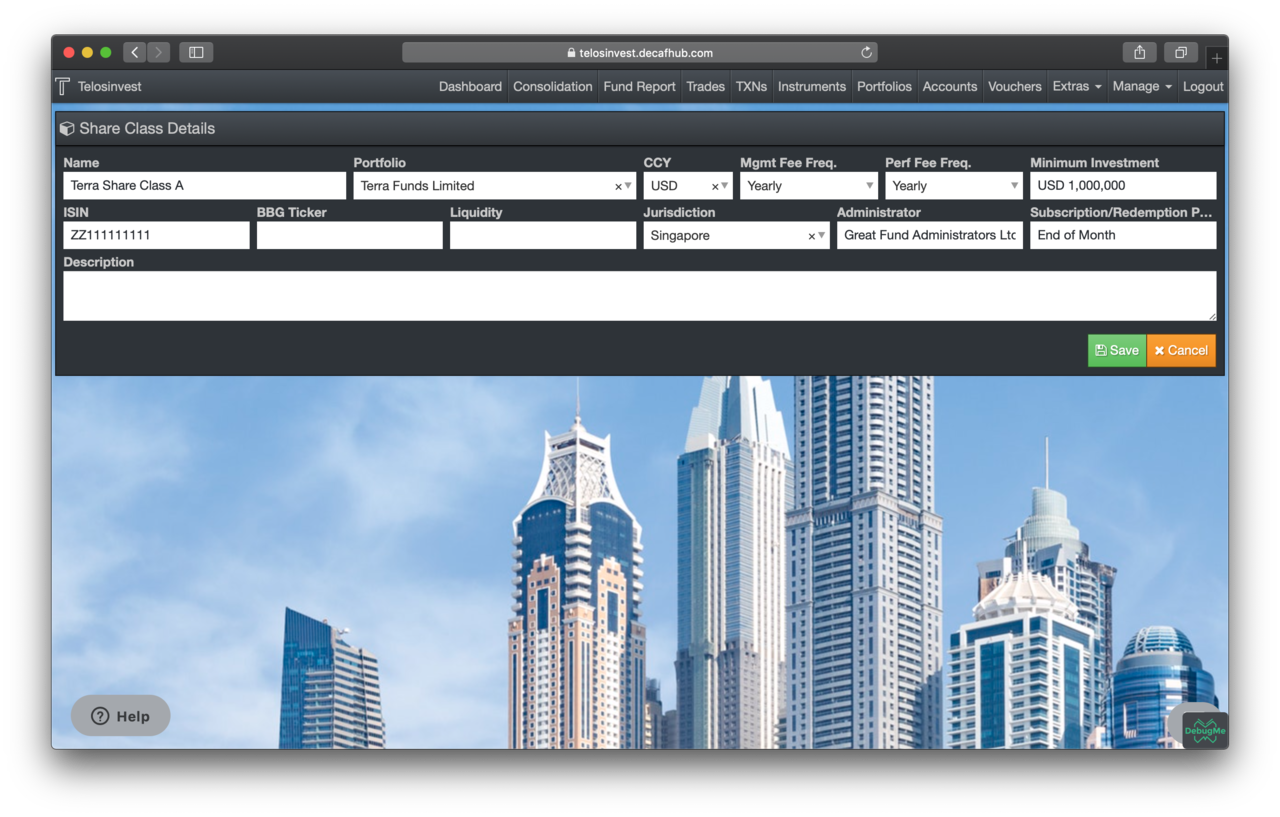

Now, our portfolio will become a fund. We need to go to "Share Classes"

"shareclass" first by following the menu item Extras > Share Classes.

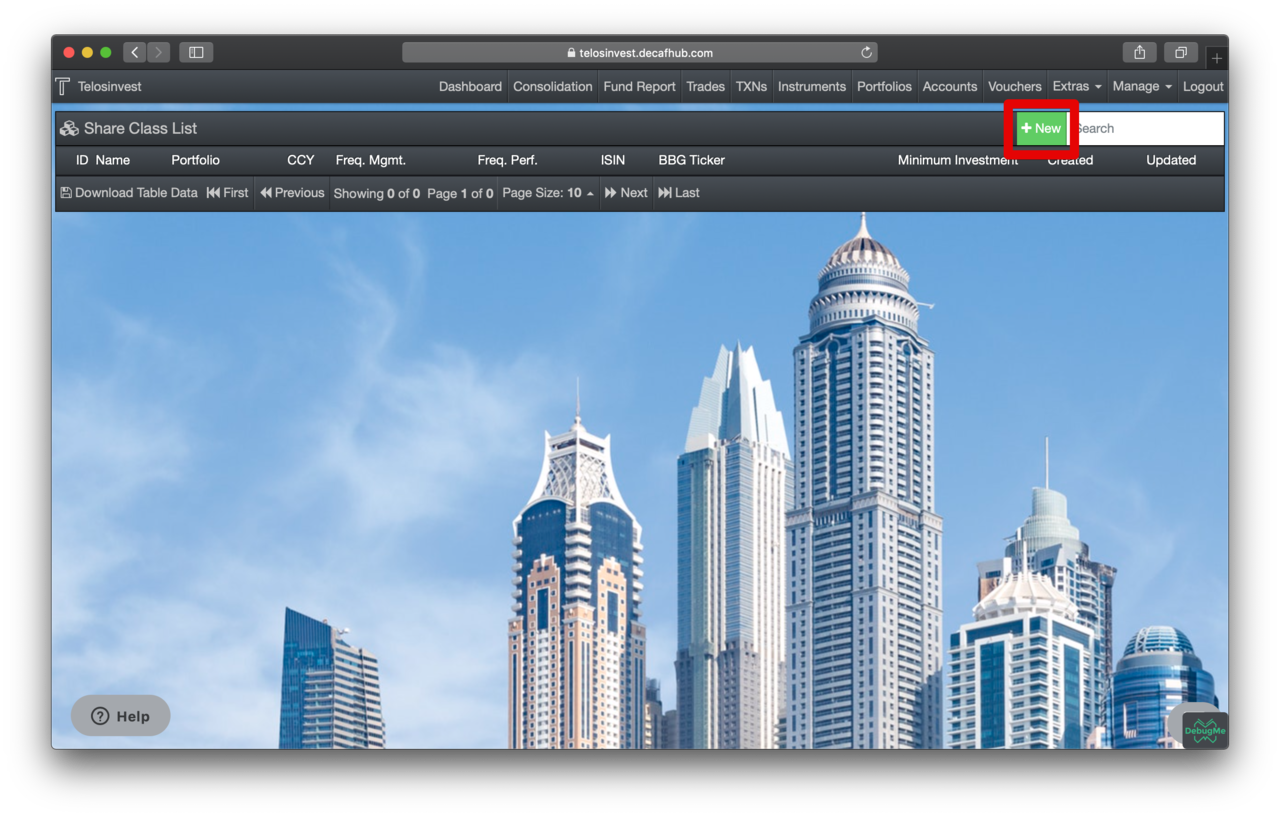

Click the new button:

Fill in the details and save:

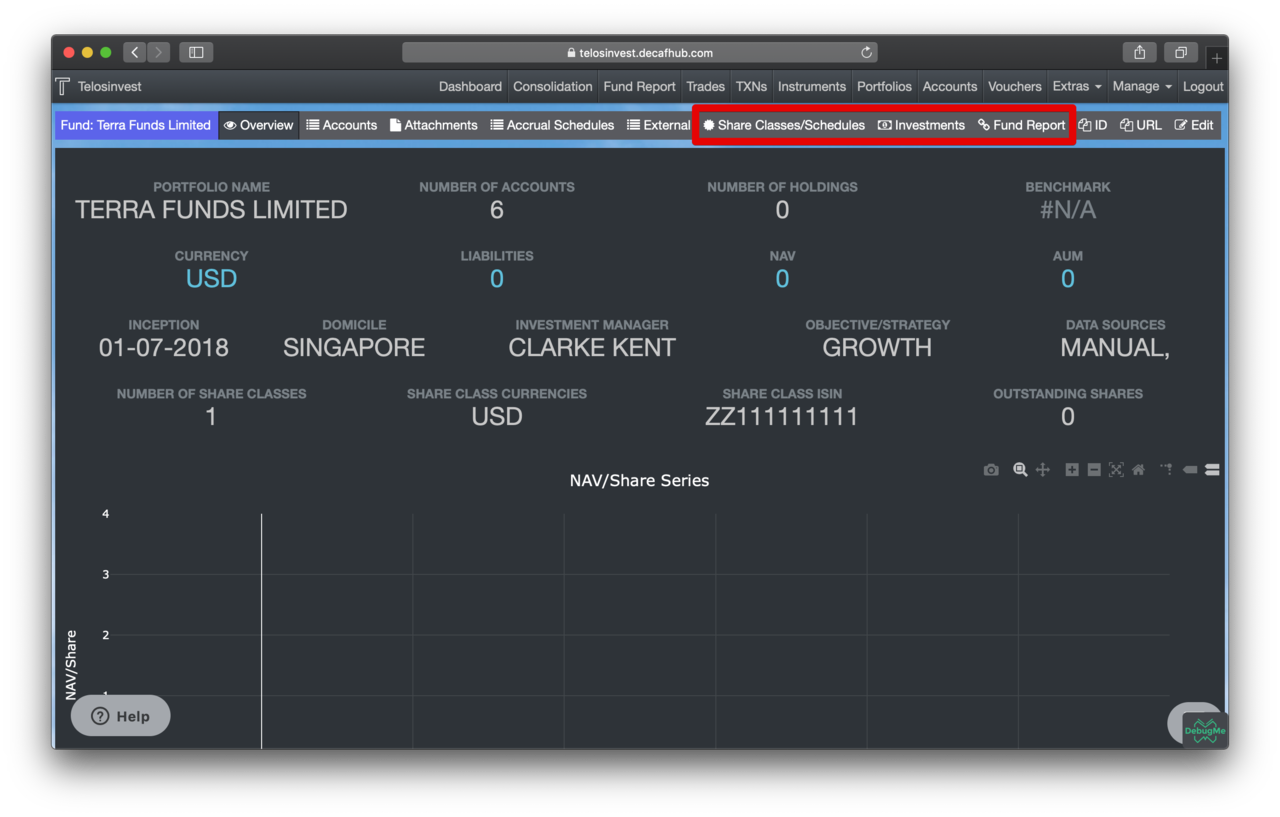

Once you create a share class for a portfolio, it becomes a fund! You can see that our "portfolio details page" has new tabs:

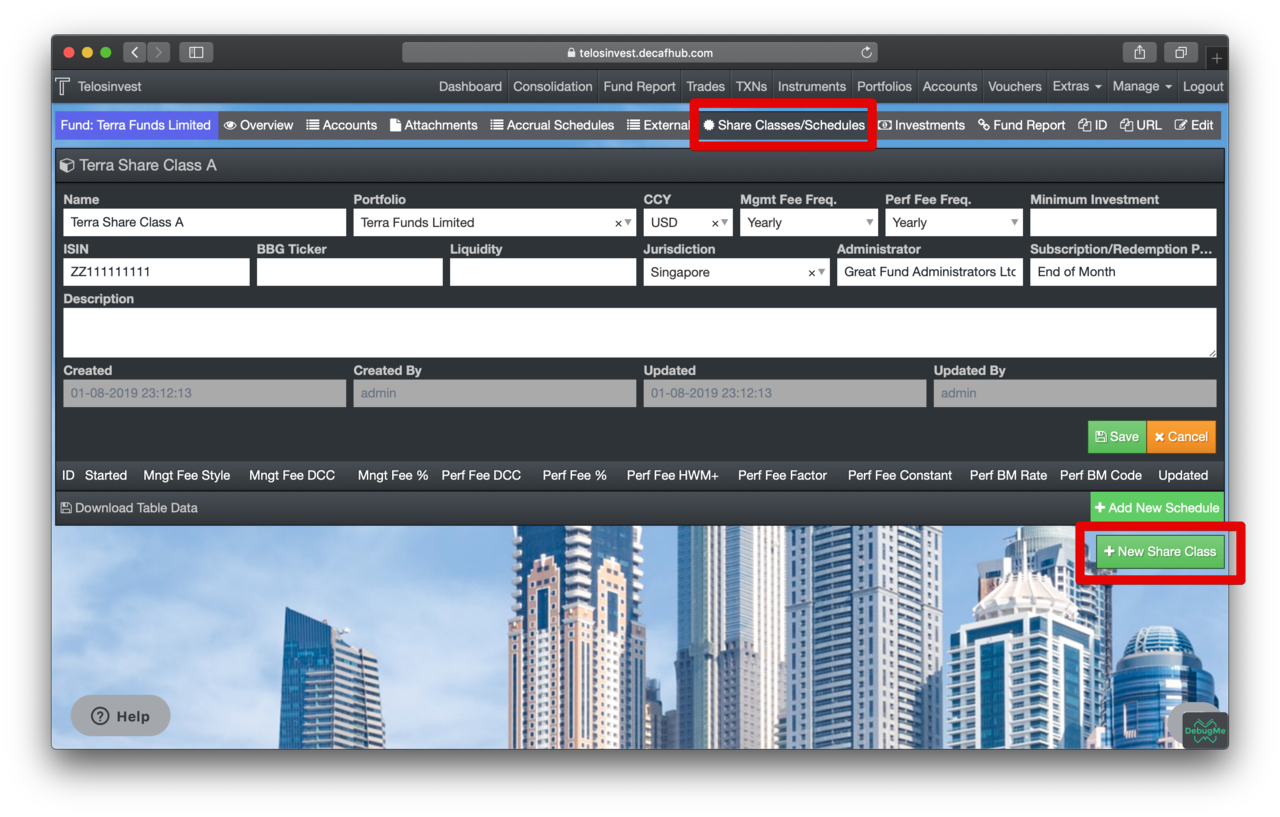

Let's create our second share class. We don't need to go to the "Share Class" menu item under "Extras" now. We can simply click on the "Share Classes" tab on the portfolio details page.

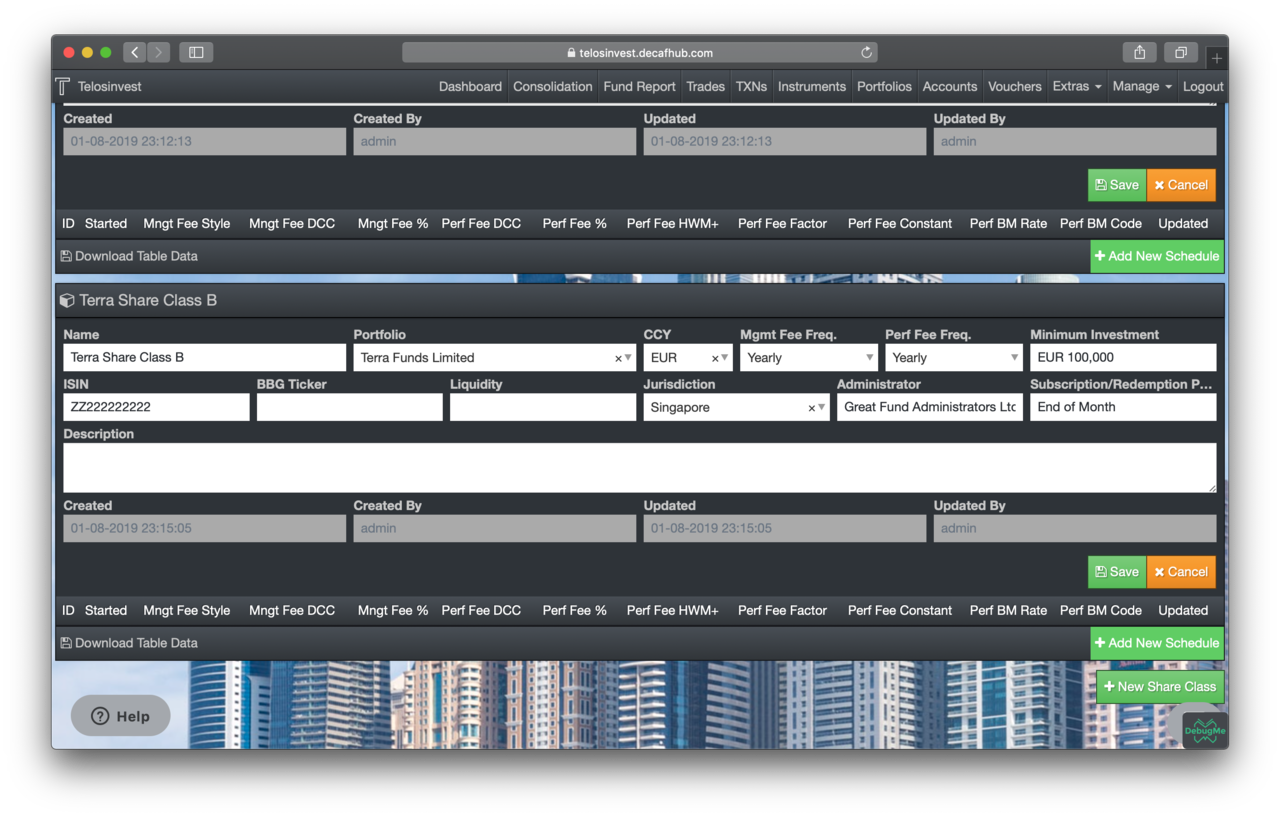

Let's fill in the form and save like the way we did for the first share class.

Setting up Share Class Related Accrual Schedules

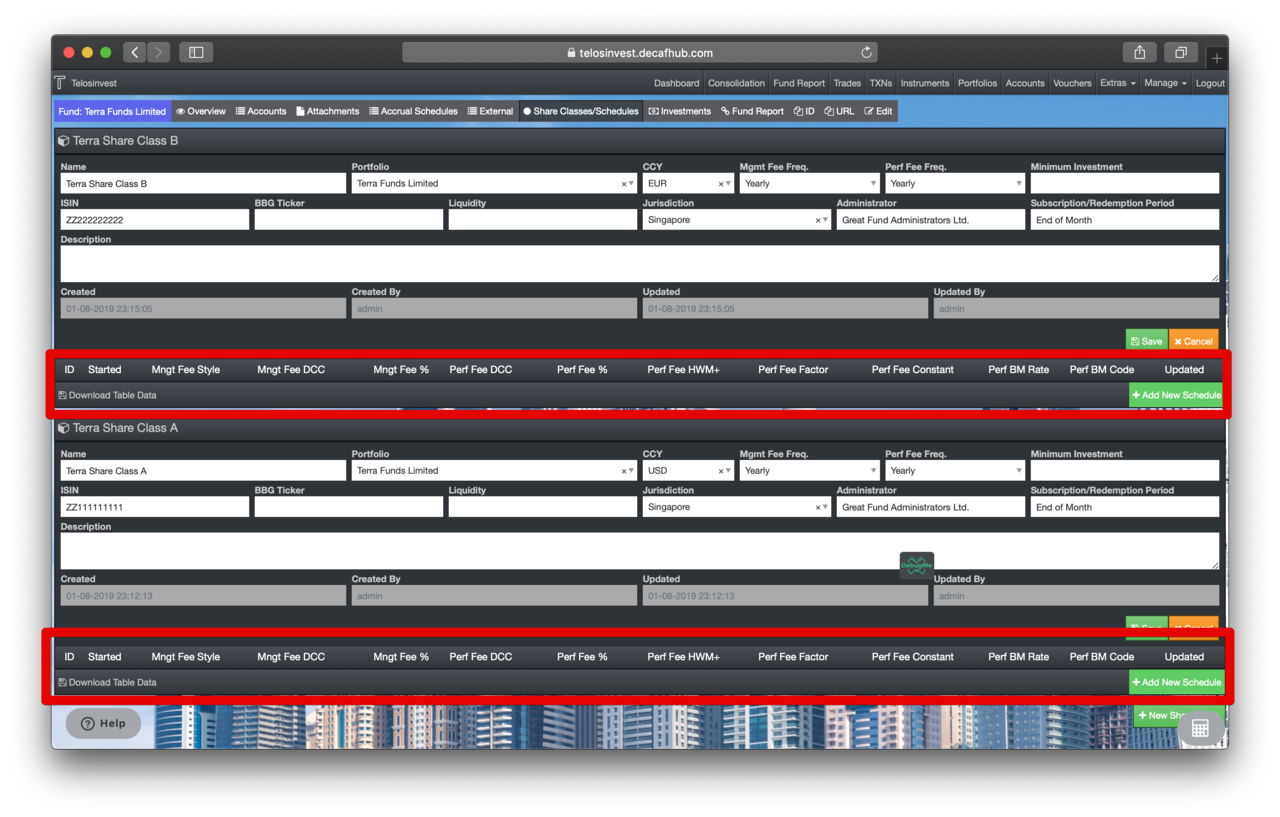

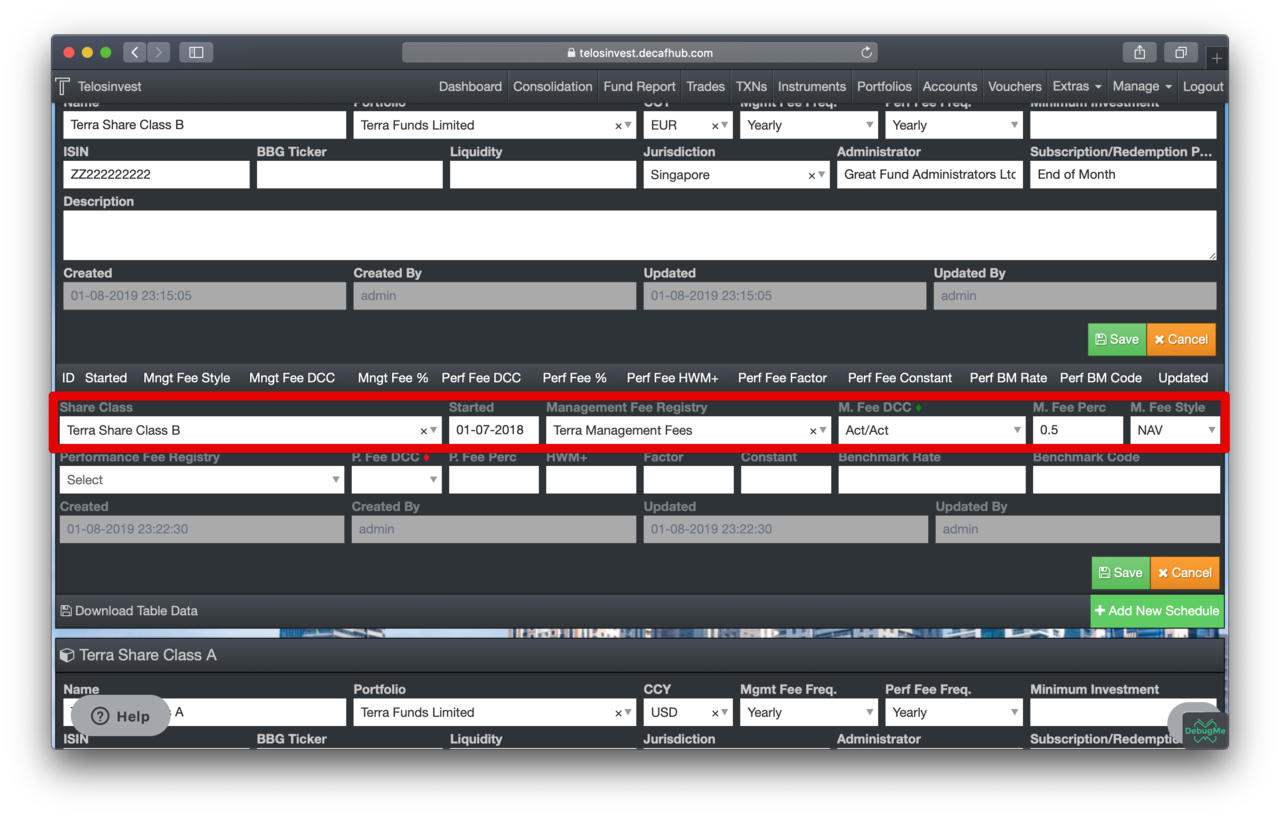

We will create a share class fee schedule for each of our share classes (for share class management fees). Note the table and "Add New Schedule" bottons under each share class:

Let's create our first share class fee schedule.

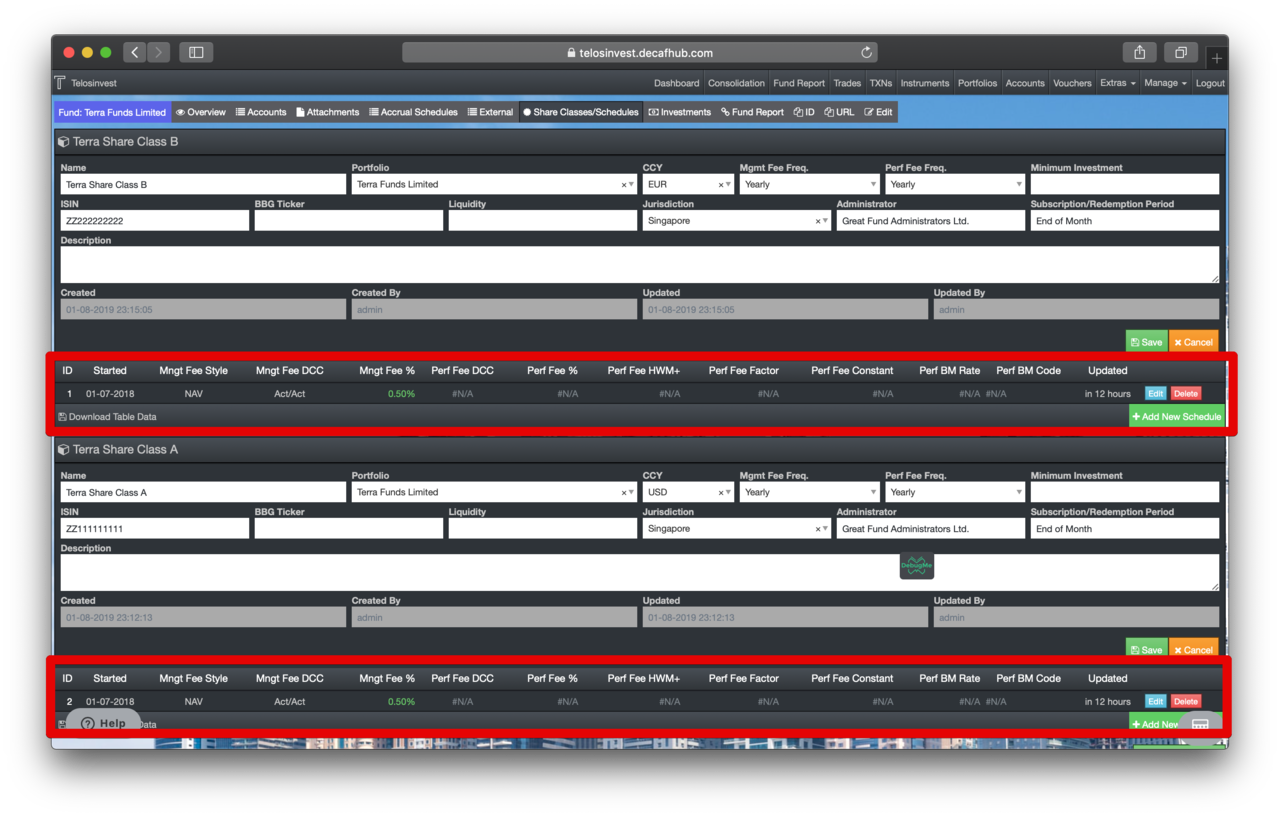

After creating the second one, too (almost same as the first one), you can see that we have two share class fee schedules:

This marks the end of our fund setup story...