REMAP

Introduction

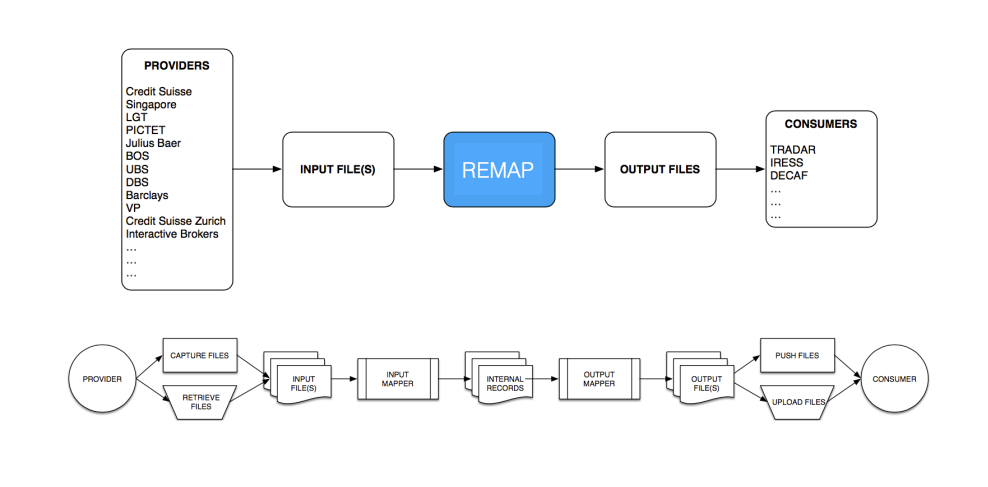

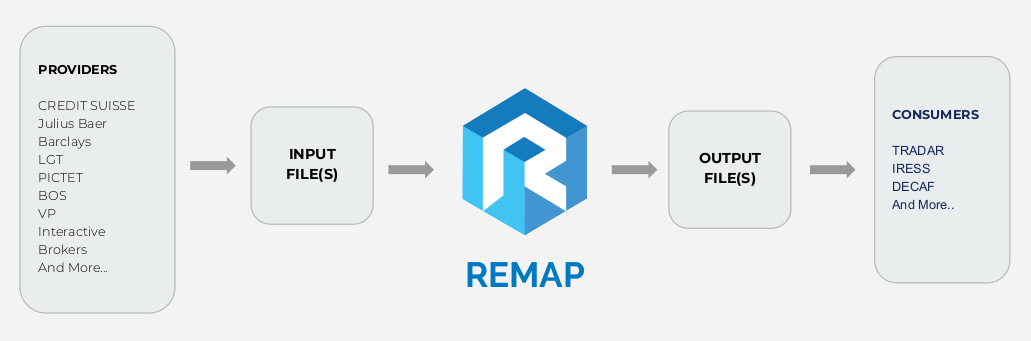

REMAP is a flexible, user-friendly & transparent middleware which empowers financial service companies to monitor, control and manipulate the financial data flow in an intuitive, efficient and scalable manner. REMAP is a Data Pipeline Management & Data Mapping platform, which is a separate system and is able to function independently.

Requirements

What are the technical requirements to use Remap?

Data Flows

REMAP is able to receive data from any source system, be it standardised third party data formats or internal files, and stream data to any target system.

Within Remap, there are 2 main services dedicated for each client:

- Dedicated Data Feeds (data feed: inward pipeline)

- Dedicated Data Mappings (bespoke, dedicated data mappers: outward pipeline)

For us to handle different forms of data input and output within REMAP, the feed and the mapping are decoupled from eachother.

As for the Dedicated Data Feeds, there are three different scenarios:

SFTP

1. Your bank has a data feed service e.g SFTP

Most of the bigger banks have such service and they usually use a standard technology called SFTP, which is a secure file transfer protocol. Some banks use slightly different methods, which we have implemented in the past (e.g Credit Suisse, Julius Baer). Essentially, it is the same process and technology.

Based on client requirements, we have so far connected to following banks which do have a data feed service:

- CUB

- Pictet

- Credit Suisse

- LGT

- VP Bank

- Julius Baer

- Nordea

- Goldman Sachs

Each of the connection is established quite fast and usually takes 1-2 weeks depending on how fast the custodian bank can set up a SFTP account for you.

Spreadsheets

2. Your bank does NOT have a data feed service, but provides spreadsheets

Some of the local/smaller banks do not have a data feed service, but they do provide some form of online banking and are able to provide excel files (statements, advices etc.). Many software vendors won't be entertained with such situation. REMAP, however, provides a solution for such case as well.

We will setup a dedicated email address for you. Either your operations or the counterparty itself may send these files to the dedicated email address. REMAP then will automatically handle the retrieval and the processing of the data.

Based on client requirements, we have set up such process for following counterparties (including banks, brokers and bespoke client files):

- Safra Sarasin

- Bank of Singapore (data feed service soon launched)

- UBS (data feed service soon launched)

- DBS

- Caceis

- Instinet

- Credinvest

- Convergex

- Cowen

- UCAP Options

- UCAP Bonds

- UCAP FX

- UCAP Minifutures

PDF

3. Your bank does NOT have a data feed service NOR spreadsheets

In very few circumstances, the bank doesn't provide any form of structured data and only rely on the PDF statements. To our knowledge, no PMS system will entertain such cases. REMAP, on the other hand, will try to solve this issue by using PDF parsing and text mining algorithms. Again, in this scenario you or your counterparty can send the PDF to a dedicated email address after which the process will be handled automatically.

WebAPI

3. Your bank does have a WebAPI

Could you please provide some information or add an explanation here?

Please note:

-

The success of the parsing and mining cannot be guaranteed. If the succcess rate of the parsing is not 100%, our system will send you a suggested excel file which will need to be manually checked by your operations and resend to push into our system.

-

If you require to outsource manual inputs, we can offer help in such cases, too. So far, we are parsing the PDF's ONLY in the case of Banque Cantonale de Geneve.

Data Feeds with third parties

We are constantly adding new data feeds from various sources, most dominantly during onboarding processes. So far, we have successfully worked with following third parties:

- Bloomberg

- Credit Suisse

- VP Bank

- J Safra Sarasin

- Pictet

- Julius Baer

- Saxo Bank

- Ansbacher

- Volksbank

- LGT

- Societe General

- Lombard Odier

- Instinet

- Credinvest

- Interactive Brokers

--> Choose between Option A and B

--> Choose between Option A and B

--> Option B

--> Option B

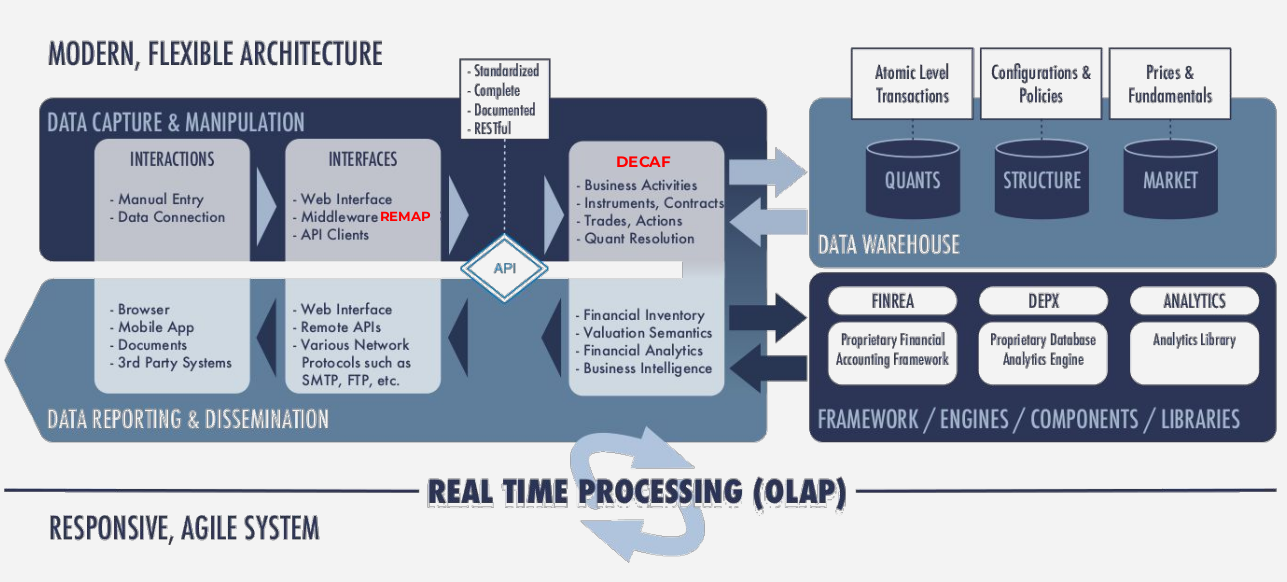

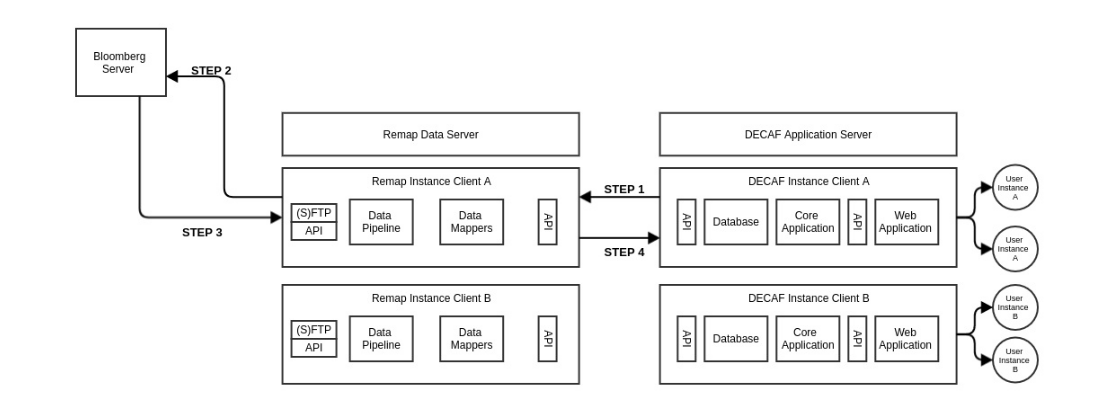

Architecture REMAP & DECAF

The following architecture shows the complete integration of REMAP and DECAF. Starting with Data capture and manipulation in which various data sources in different format are digested and processed within REMAP. Once the data is processed and mapped the data is streamed via DECAF into our Data Warehouse. Later on, various funcationalties and concepts are applied within our framework to send our processed data into our reporting and dissemniation framework. The complete process is in real-time and in an agile way.

--> Please verify and change accordinlgy.

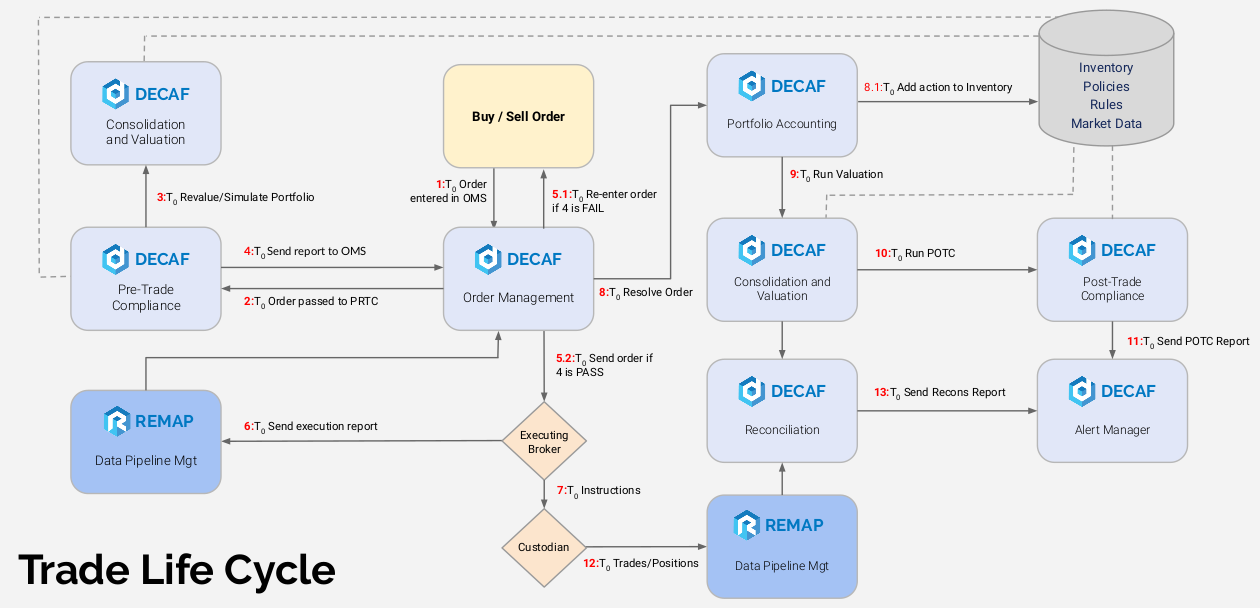

Trade Life Cycle

--> needs some explanation!

Bloomberg Data Flow

Step 1

Every client has a dedicated Remap instance with its own data pipeline and data mappers. In Step 1, the remap instance periodically prepares request file with bloomberg tickers and required fields.

Step 2

The request file is sent to the bloomberg sftp server.

Step 3

The response file is pulled by the remap instance’s data pipeline.

Step 4

The client’s dedicated data mapper parses and prepares the incoming data and pushes the data into the client’s instance data base.

Use Cases

Should we add some use cases?