Pending Fund Subscriptions

1. Introduction

This guide explains the best practice when it comes to entering pending subscriptions as trades into the DECAF system.

When portfolio invests into a fund, it often has to wait until the final fund price is for the period is issued before the trade is materlized, while it already has pledged a monetary amount into the fund. In such cases, the aim is to be able to:

- reflect the commitment to the fund as a risk-bearing position,

- have an unchanged cash position as it has not yet been paid and

- ensure, ceteris paribus, that NAV of the portfolio as a result of this commitment is unchanged.

Below is a best practice guide on how it can be accomplished. The steps can be broken down into 2 pahses, namely the pending phase and the subscrption phase.

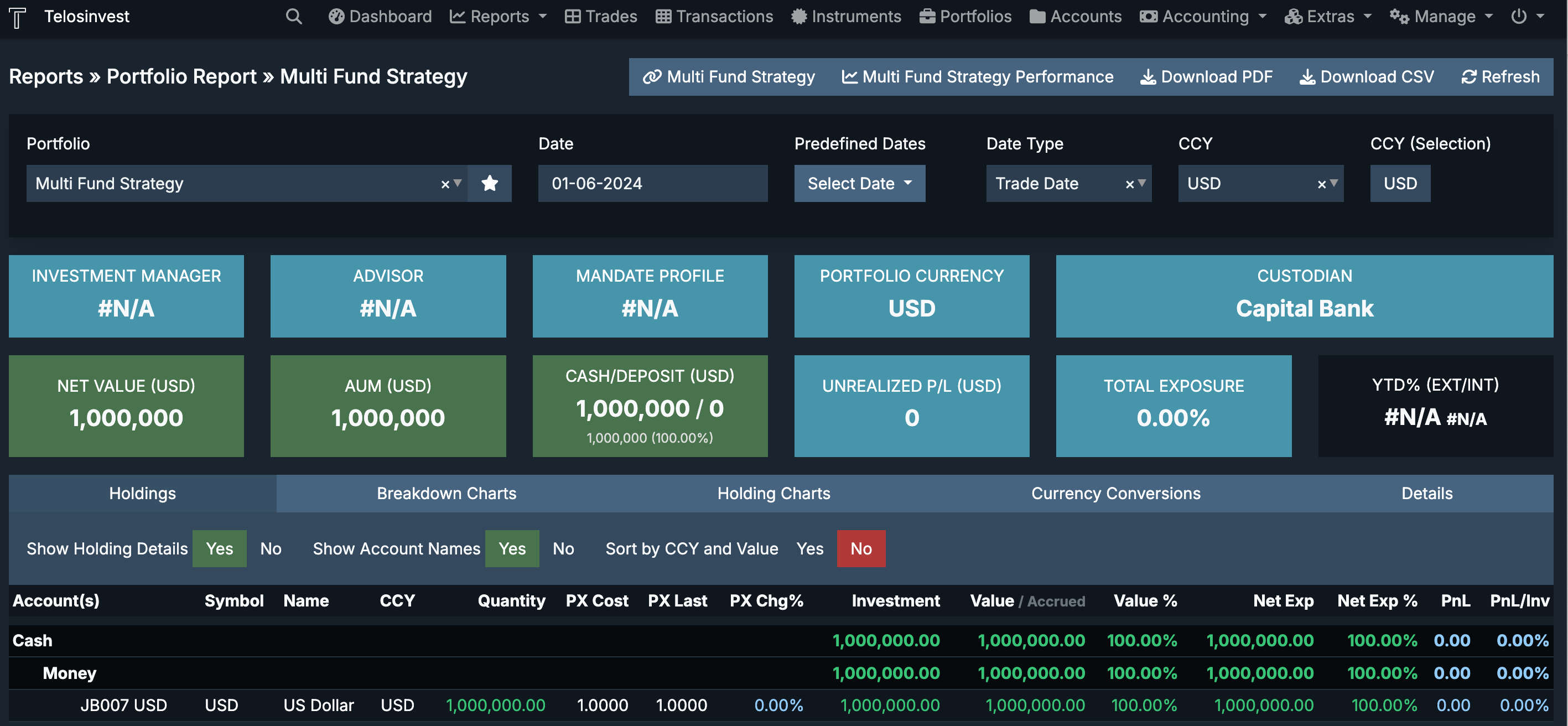

Let's assume we have a portfolio called Multi Fund Strategy, which has started on the 1st of May, 2024 with a initial cash position of USD 1,000,000.

Before we start adding the trades into the system, we strongly recommend to maintain a separate analytical account under such portfolio. This account has to be setup only once for each portfolio and will help separating the actual cash amount and the committed cash amount. We explain how such account can be created in the next section. You can skip the next section if you already know how to or already have a analytical account.

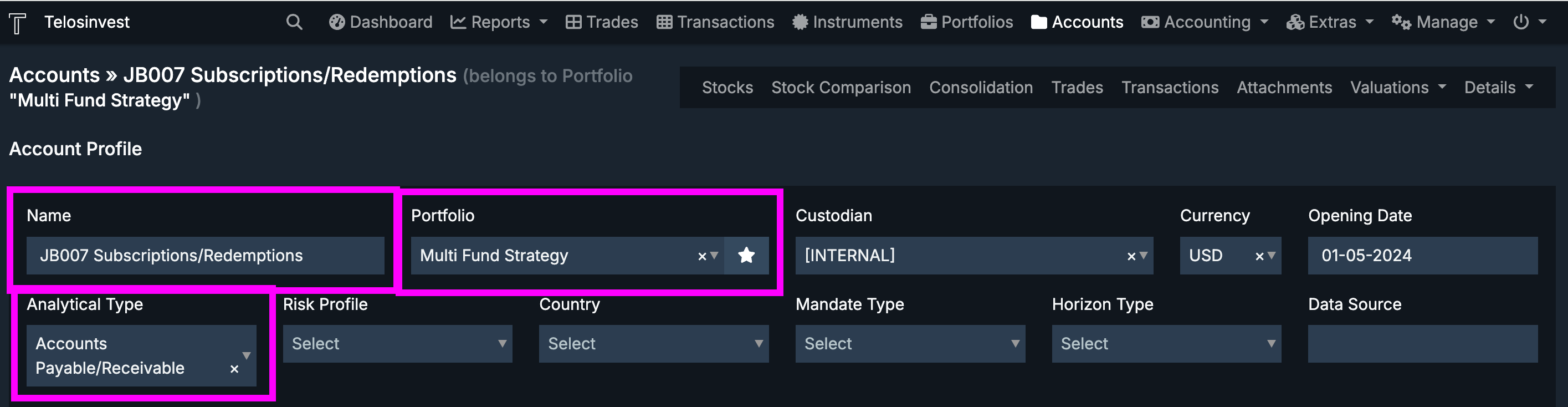

2. Creating a Analytical Account

Under the Accounts menu, you can create a new account as shown below. The

account name can be aribtrary, but you are advised to use a name with a contet

which you can refer to.

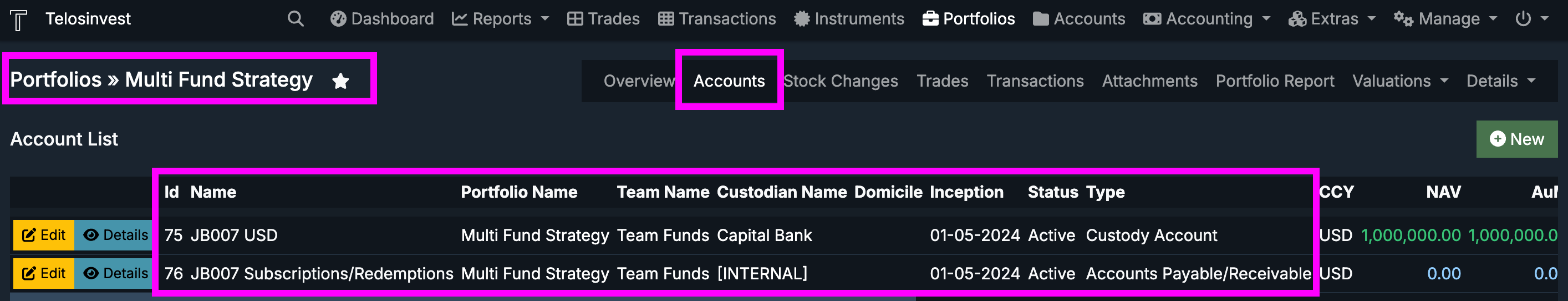

After this step, the portfolio will have a Accounts Payable/Receivable type

analytical account besided the custody accounts.

Now, we can go to the steps of creating the trades for a) the Pending Phase and b) the Subscrption Phase.

3. Commitment into a Fund (Pending Phase)

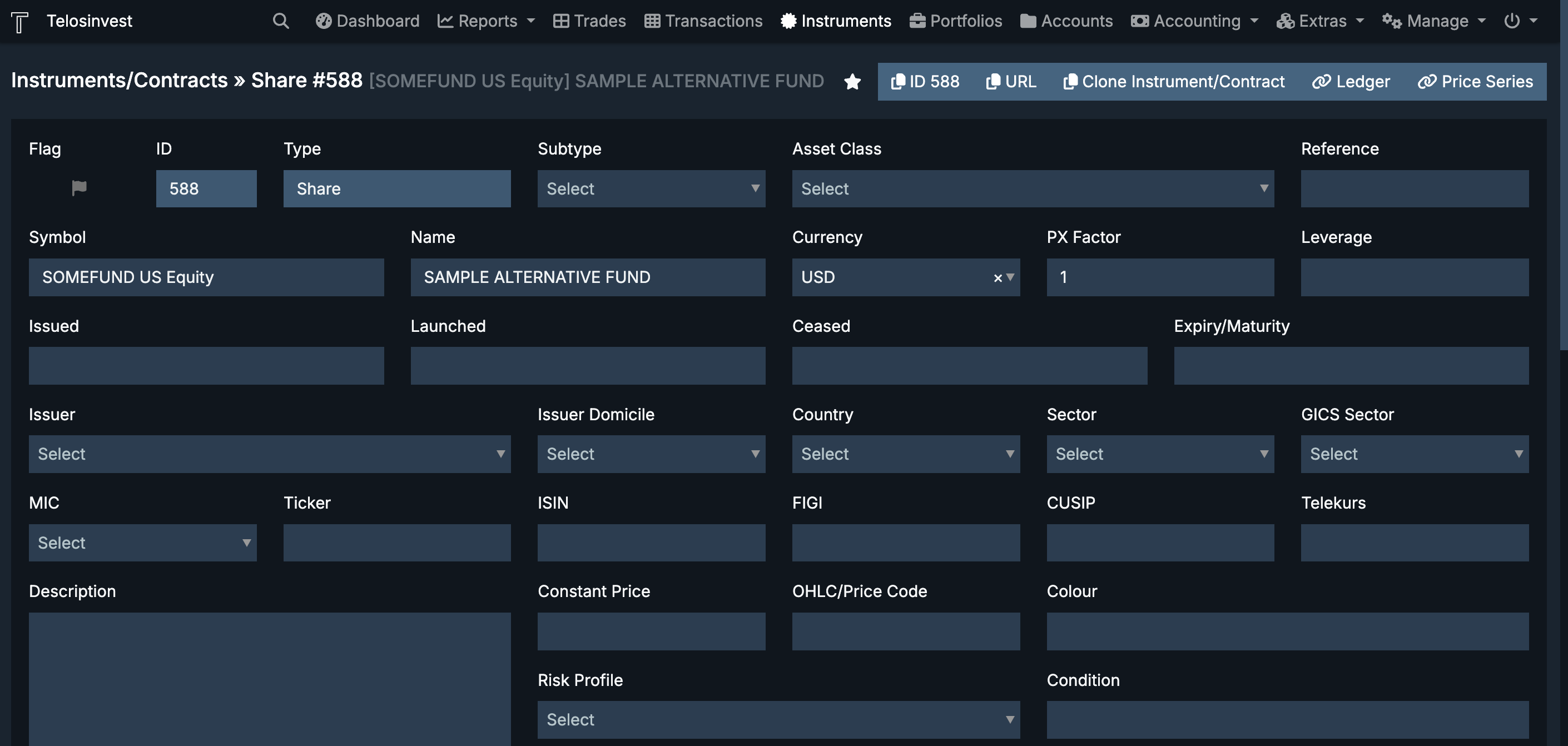

Let's assume that on the 15th of May, our portfolio has committed to buy USD 500,000 worth of shares of the SAMPLE ALTERNATIVE fund which issues fund NAVs at the end of every month.

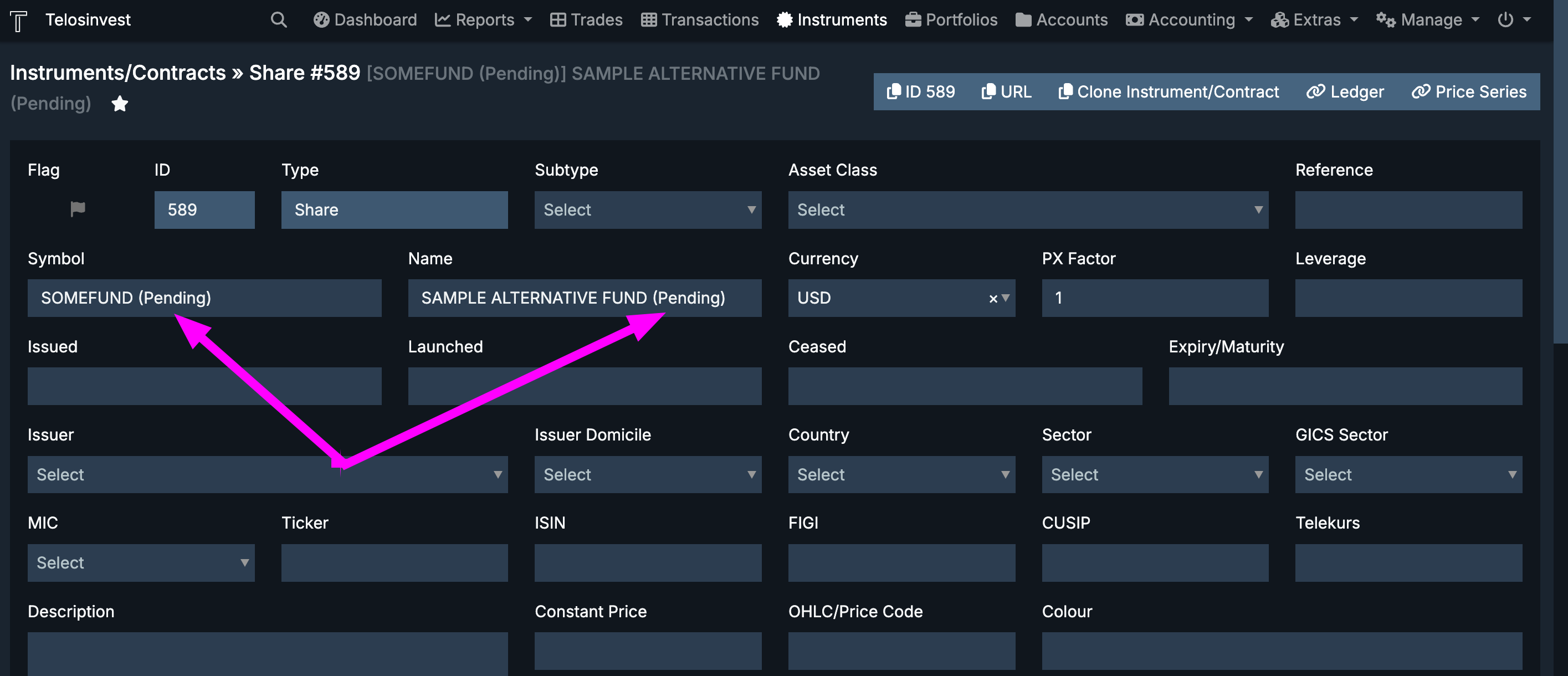

The actual instrument of the fund is shown in below screenshot.

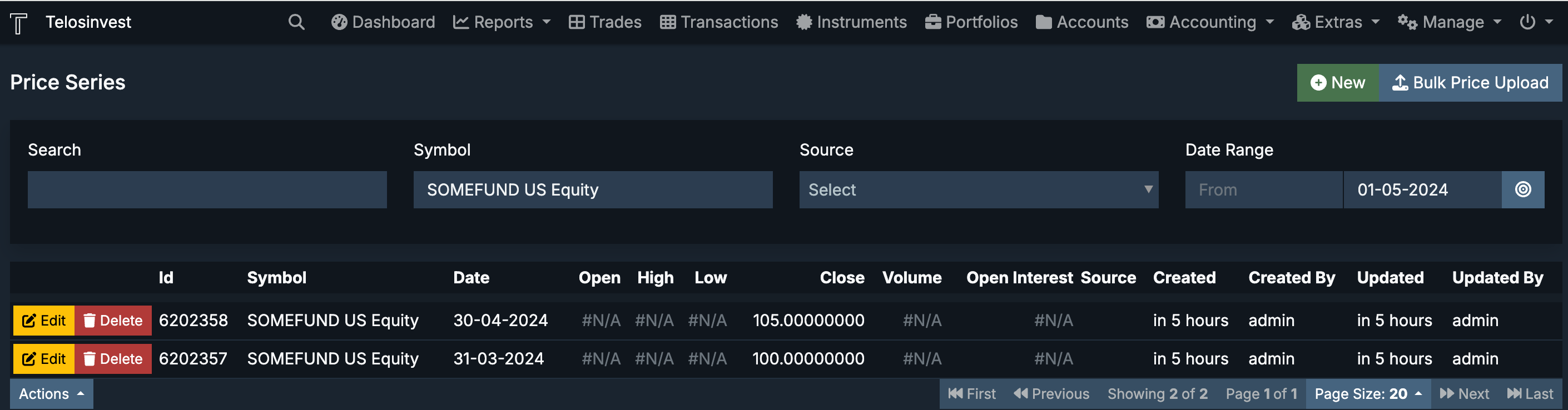

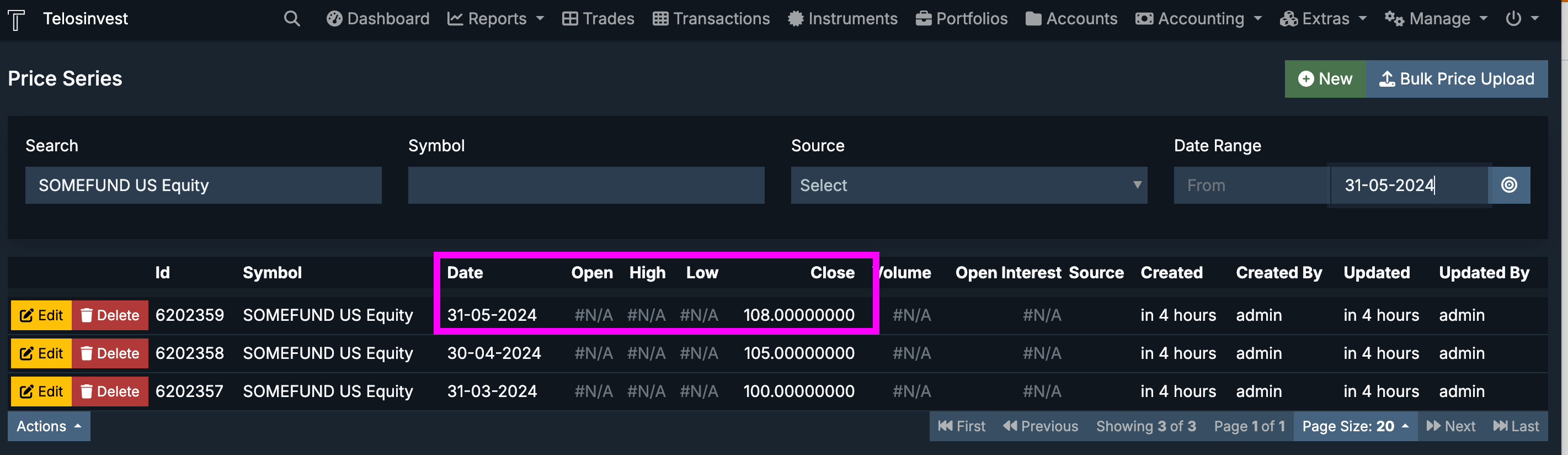

As mentioned, we assume that this fund issues monthly NAVs, which is reflected in the price series of its symbol.

Now, let's go to the indivdual steps to be taken on when the commitment is made on 15th of May.

3.1 [Step 1] Create a temporary instrument

First, create a temporary instrument which does not have a valid or active price in the system as we DO NOT want this position's value to get updated once we reflect it in the portfolio during the pending phase.

3.2 [Step 2] Create trade for temporary instrument

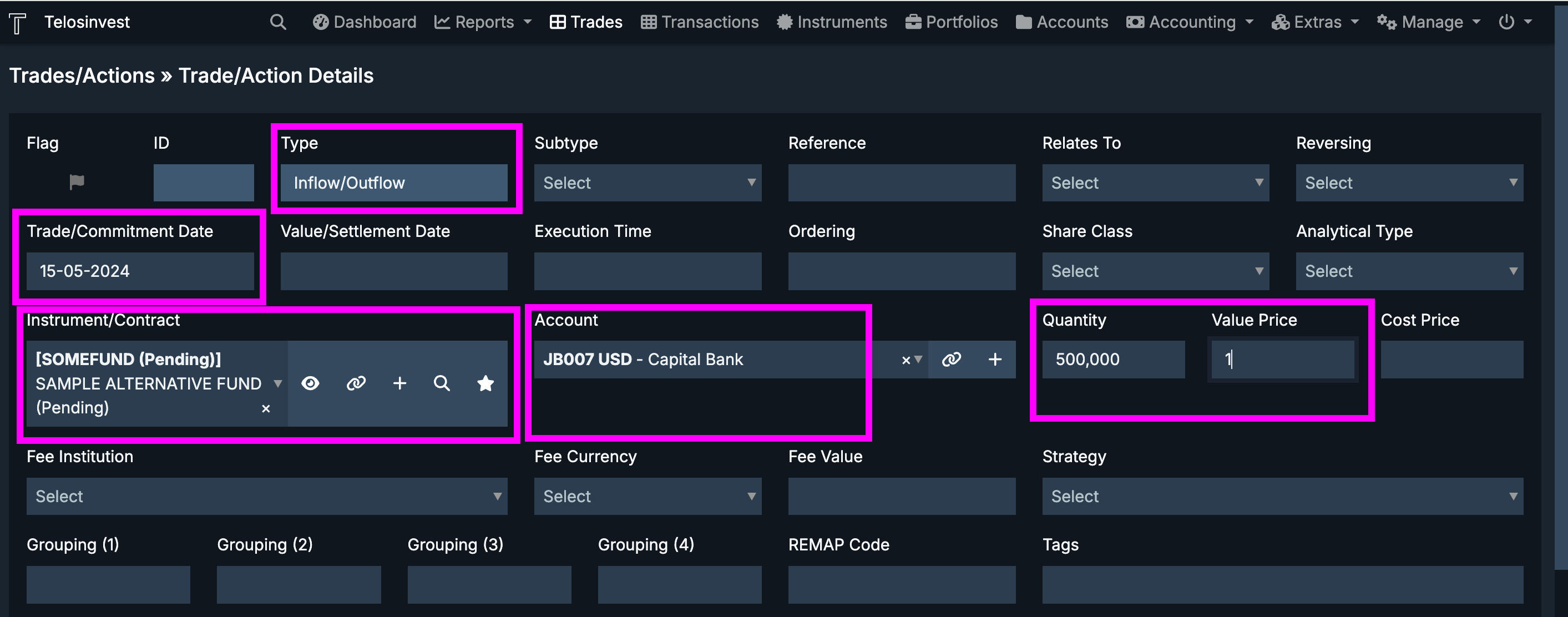

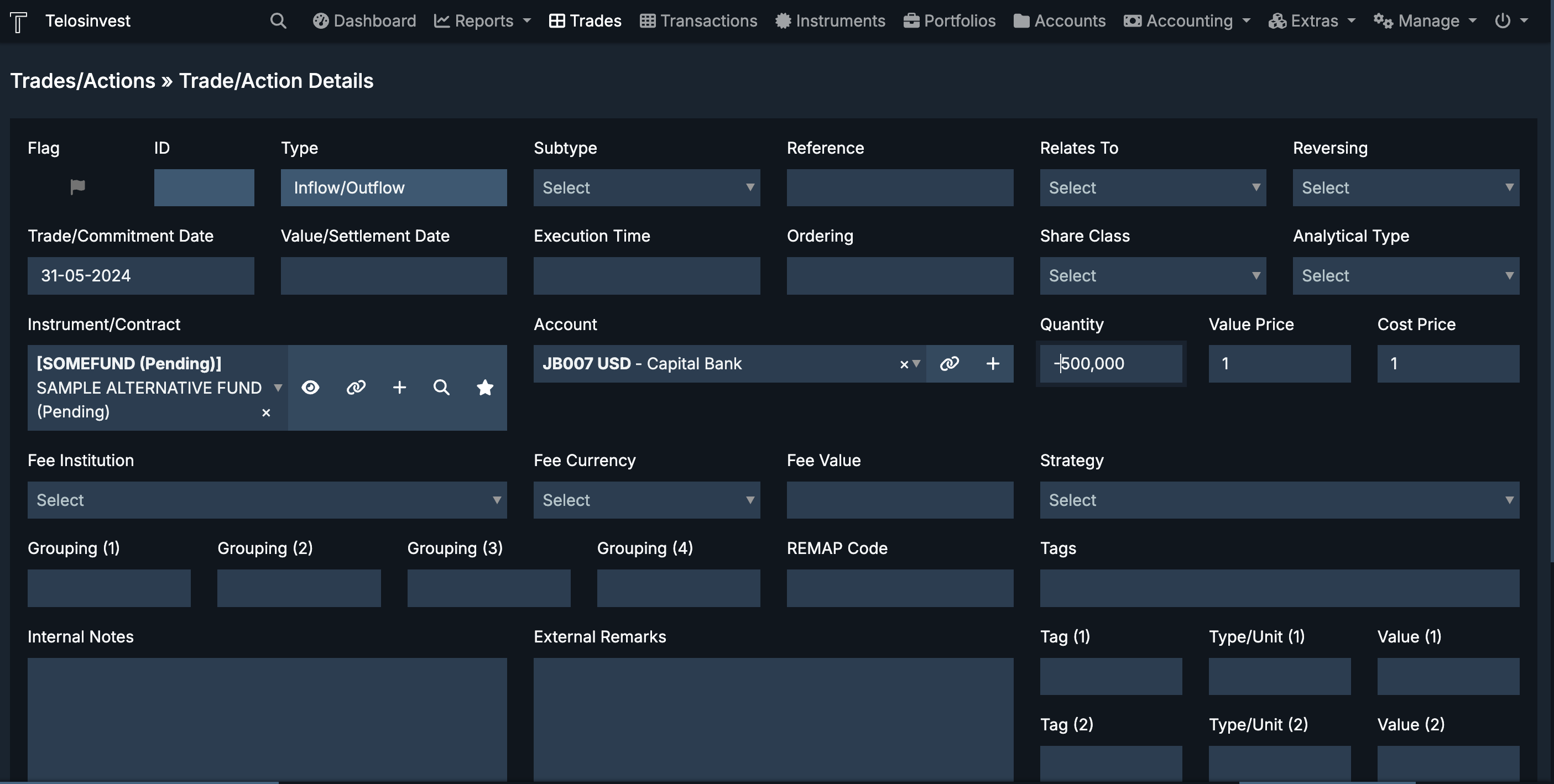

Next, create a Inflow/Outlfow trade of the temporary instrument whereby the value of the trade is equal to the commitment amount, i.e USD 500,000.

Note: The value of a Share type instrument is calculated as QTY x Price Factor x Market Price. As the price factor does not exist, the system will fall back to the the Traded Price.

The trade can be inputted as show below.

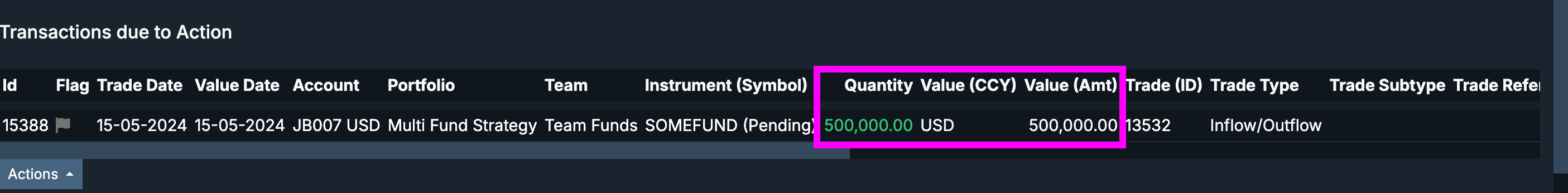

This will result in following transaction.

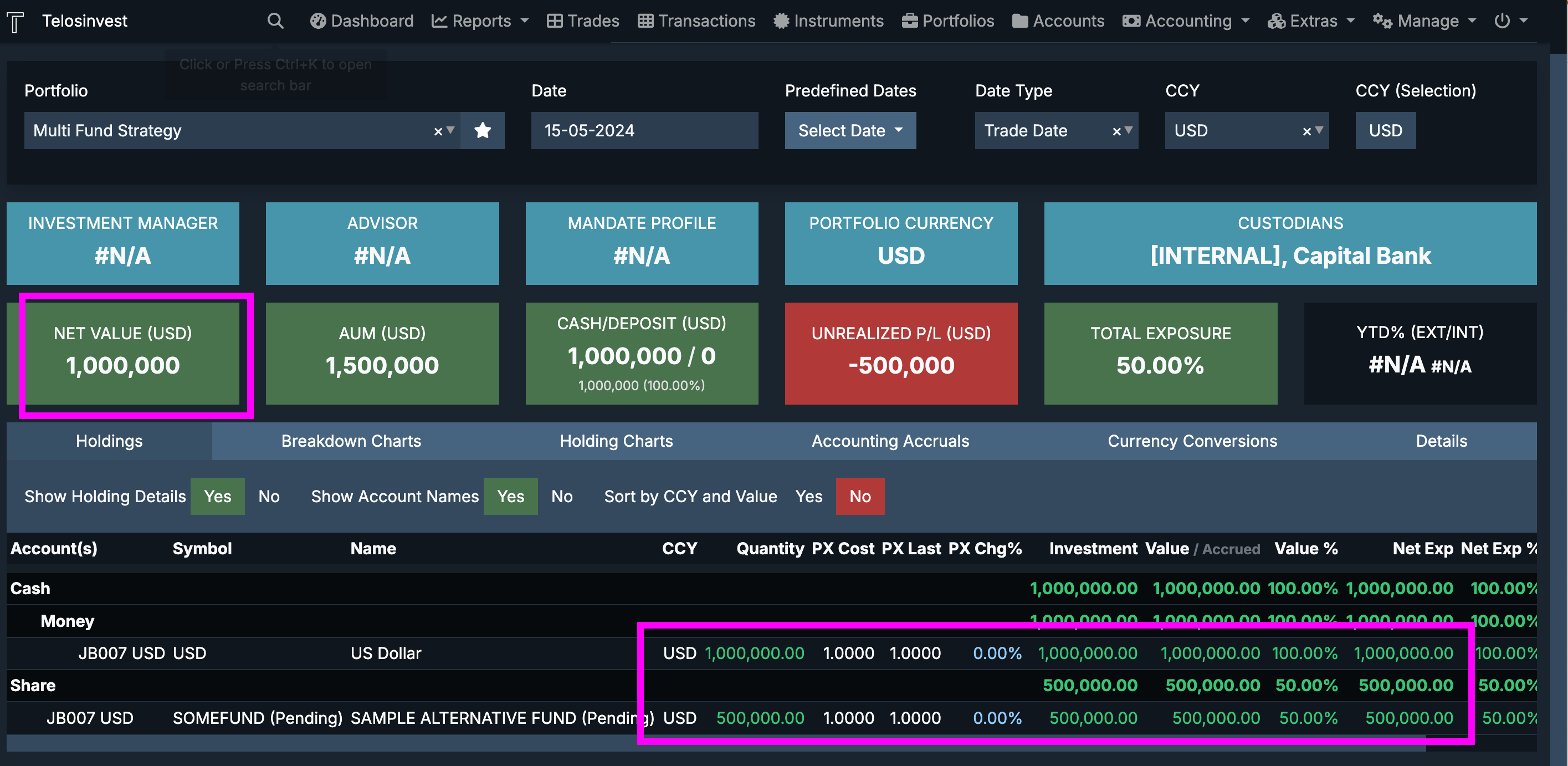

After this step, the portfolio will have an inflated NAV as shown below. We will remedy this in the next step.

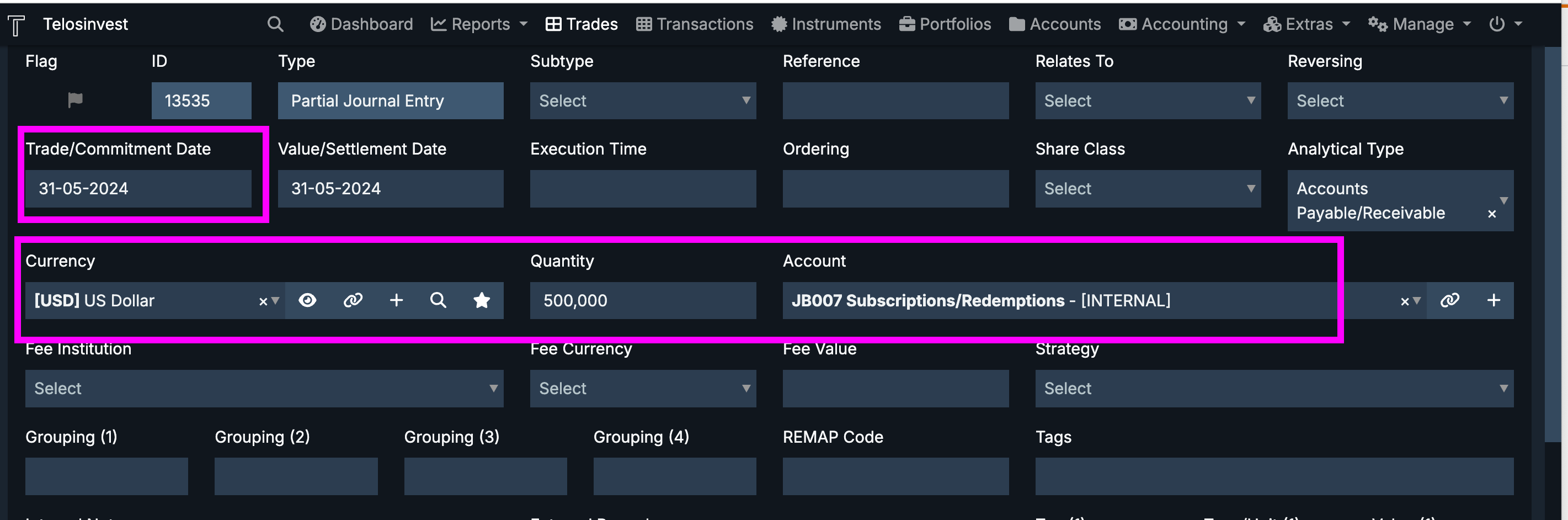

3.2 [Step 3] Create Partial Journal Entry Cash

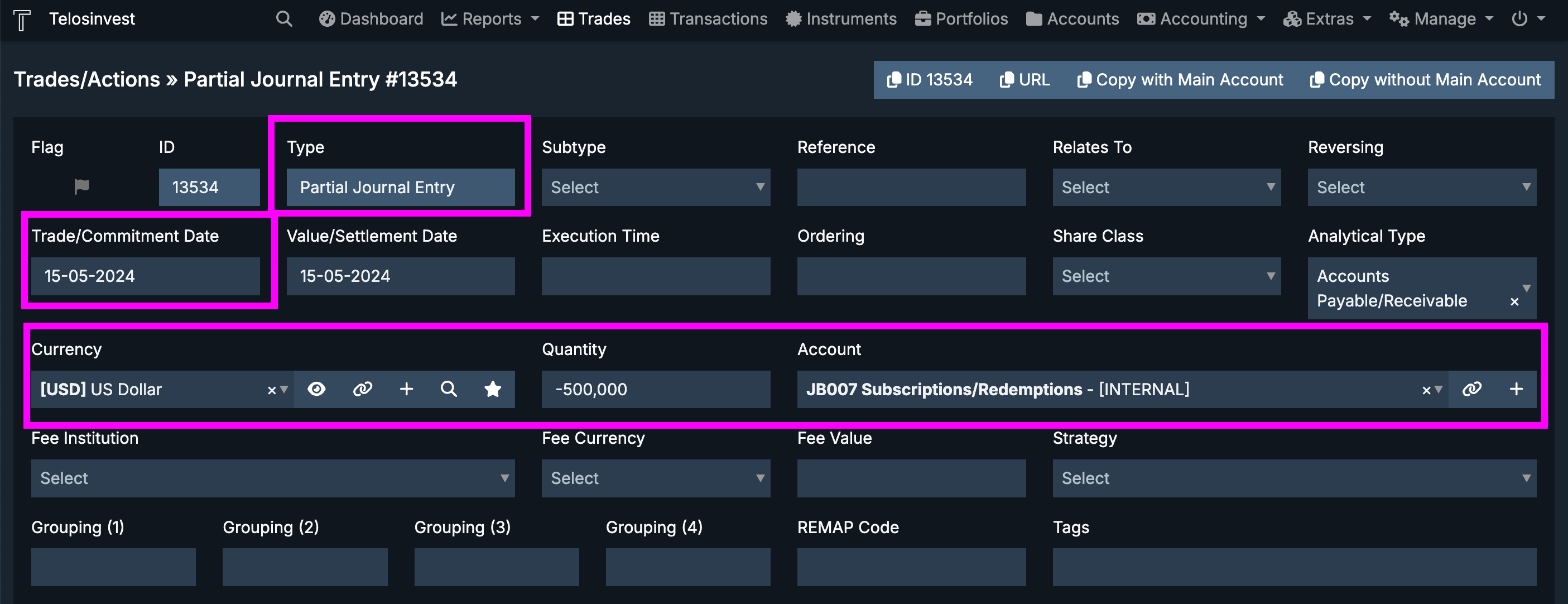

Finally, create a simple Partial Journal Entry (PJE) cash trade to offset the commited value.

Under Trades menu select New Trade/Action and choose Partial Journal Entry and enter values as shown below.

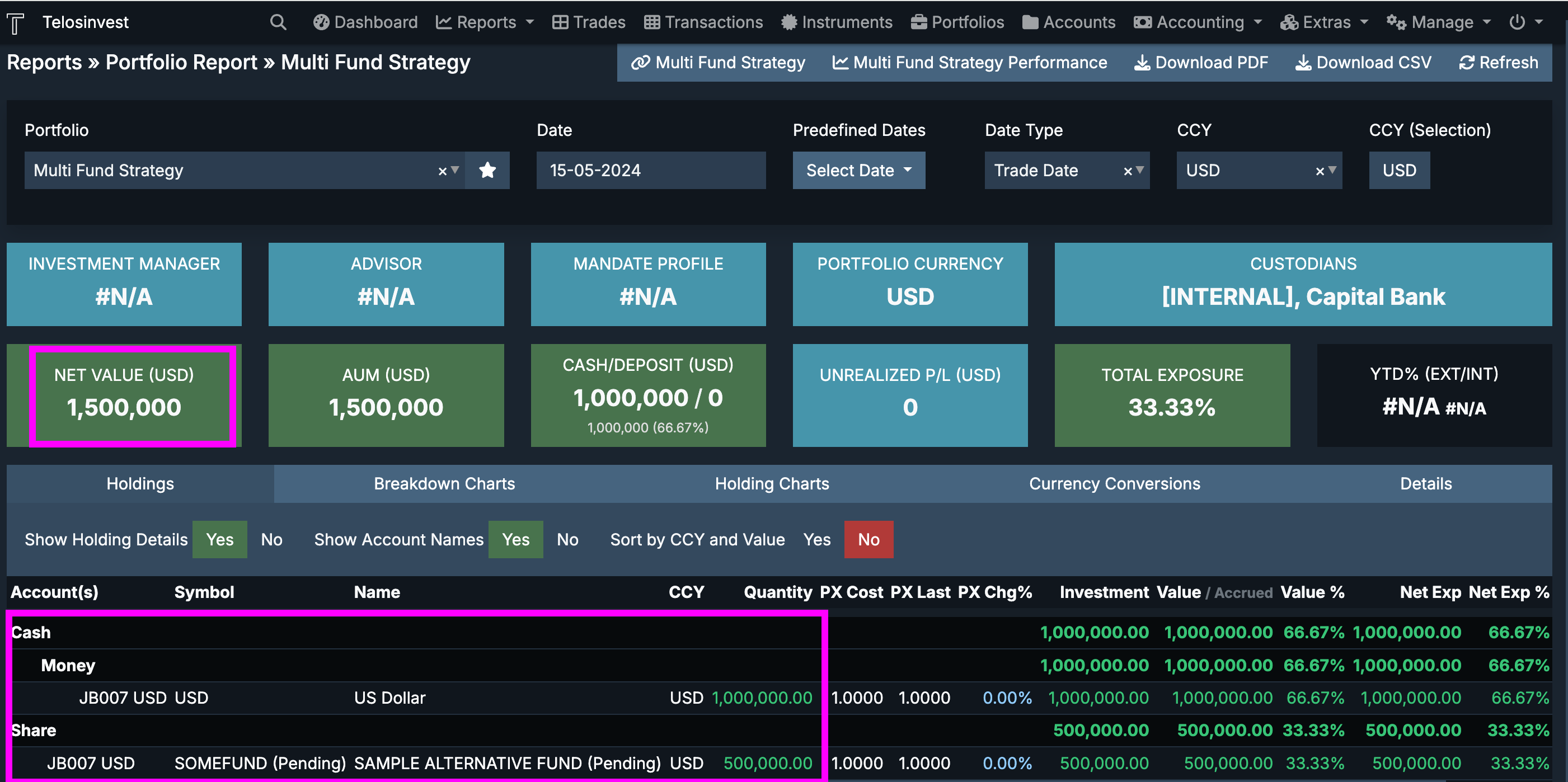

This will result in a portfolio report view as shown here.

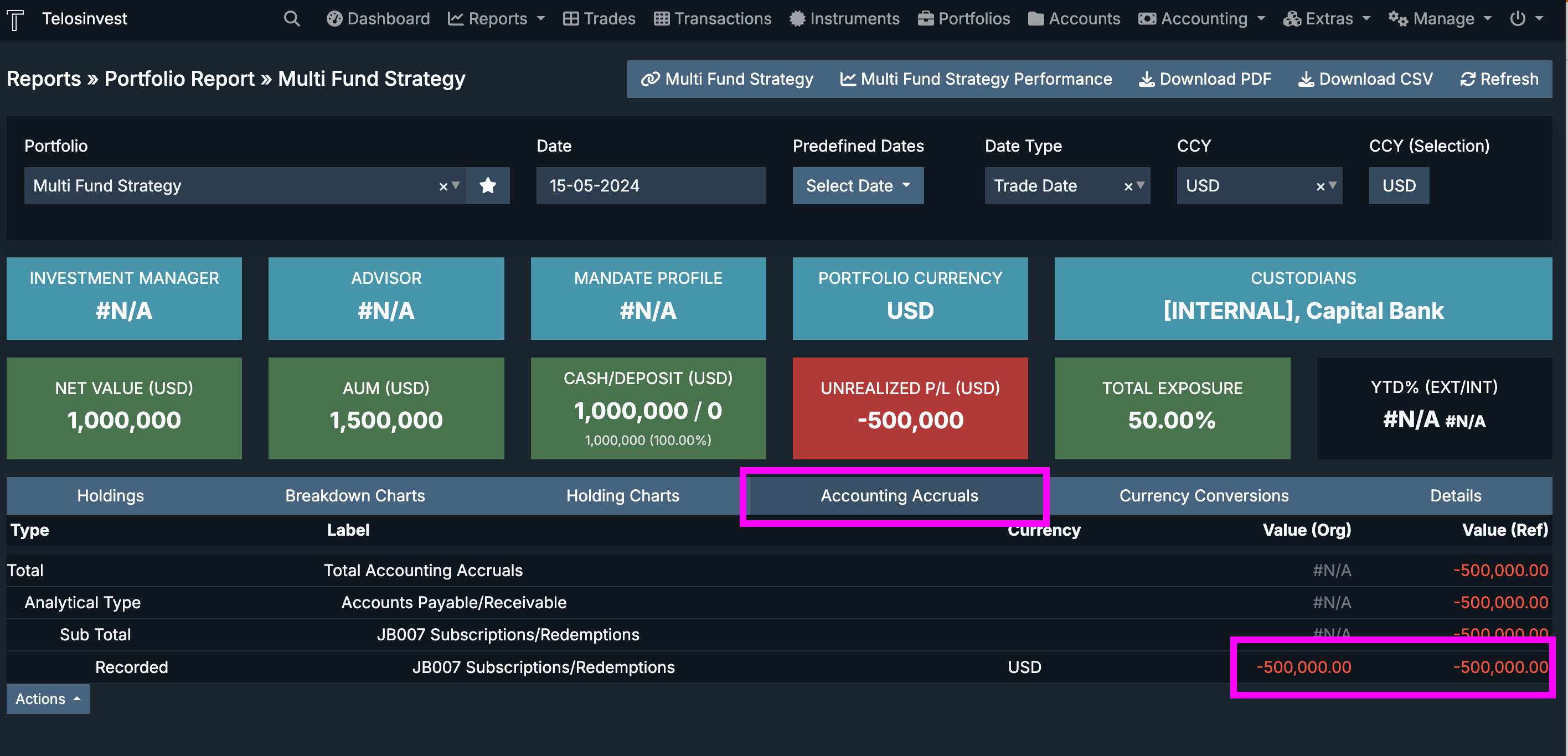

You will notice that the sum of the positions are USD 1,500,000 while the NAV is still USD 1,000,000. That is because the PJE is taken account for in the analytical account which you can see under the "Accounting Accruals" tab as show here.

This concludes the Pending Phase. We will now go over the subscription phase where we will assume that the fund has issued its NAV for the 31st of May and determine the number of shares for the actual subscription.

4. Subscription into a Fund (Subscription Phase)

Let's assume the fund as issued a NAV of 108 as reflected in the actual fund instrument's price series. Let's also assume that the fund charged a 0.5 subscription fee.

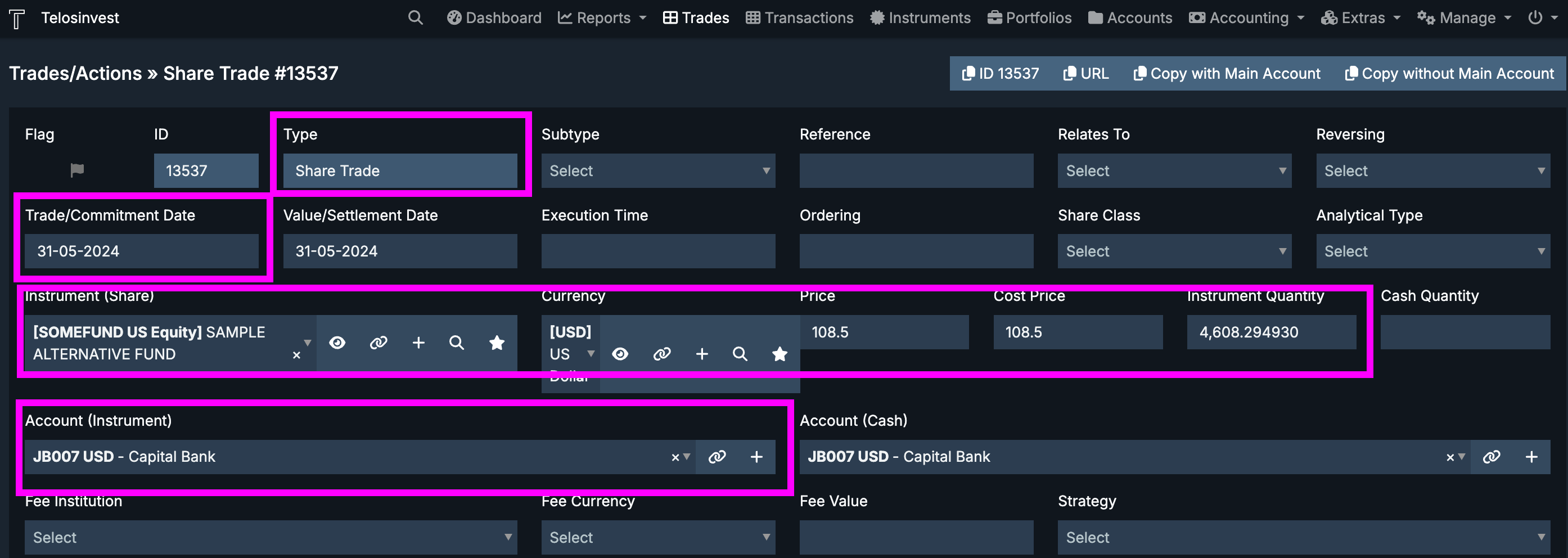

Therefore, the fund has issued 4608.294931 shares (500,000 / 108.5) to the portfolio.

In the next sections, we explain the steps to be taken to close the Pending Phase and reflect the new transaction.

4.1 [Step 4] Offset the Partial Journal Entry

You may offset the original PJE by entering a new PJE with USD +500,000 for the 31st of May. See below

4.2 [Step 5] Close the Position for the temporary instrument

Similarly, you may close the temporary position by entering a trade as shown here.

4.3 [Step 6] Create new Share trade of original instrument

Finally, create a Share trade of the original instrument as shown here.

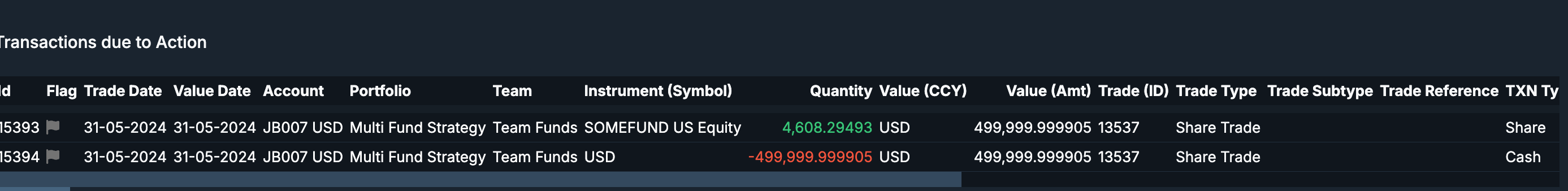

This trade will result in following transactions.

This will conclude the steps necessary to complete the Subscription Phase.

The Portfolio Report will look as as shown below.

Note: The Account Accruals tab disappears as there are no open position due to the offset of the PJE's.

5. Conclusion

Using the Pending instrument and the Analytical Accounts to reflect outstanding liabilities (or receivables) provides a) consistent NAV's and b) correct risky-bearing asset positions.